China Sets a New Renewable Portfolio Standard

China in mid-September increased its renewable portfolio standard (RPS) to 35% of electricity consumption by 2030. The country has already heavily invested in wind and solar, and it anticipates more gains will come from some provinces.

In a revision of an initial draft plan published this March, the National Development and Reform Commission (NDRC) also mandated six new entity categories that must meet the renewables obligation. The entities include provincial power grid companies owned by the State Grid Corp. of China—the largest utility company in the world—and Southern Power Grid, both which are government-owned; local power grid companies owned by provincial local governments; electricity retail companies with distribution grid operation permits; independent power retail companies; consumers participating in direct trading; and companies with captive power plants that purchase power through public power grids.

The new draft allows power generators to sell green certificates—which are distinct from those in the existing voluntary green certificate market—to covered entities, allowing them to get renewable power subsidies from national renewable development funds. The reform seeks to alleviate the government’s subsidy burden, which has gotten heavier, though it has spurred rapid uptake of non-hydro renewables nationwide. The measure also seeks to stall an increasing rate of curtailments, and follows a December 2017 mandate in which the government established a red-yellow-green alert mechanism designed to slow solar installations in provinces with high curtailment or limited transmission.

At the end of 2017, according to China’s National Bureau of Statistics, the country’s total electricity output rose 5%. Though the country is suffering a coal power glut, it added 46 GW of new thermal power generation, which ramped up its output 4.6% compared to the year before. New measures aimed at coal could deeply impact the sector, however. At the end of August, the National Energy Administration (NEA) ordered 49 GW of coal power units to meet ultra-low emission standards set by provinces by the end of 2018 through retrofits, and 54 GW of units nationwide to meet new energy savings mandates. The ultra-low emission standards could require coal units not to exceed 5 milligrams/cubic meter (mg/m3) for particulates, 35 mg/m3 for sulfur dioxide, and 50 mg/m3 for nitrogen oxides—and respectively, these standards are 75%, 30%, and 50% lower than the upper limits defined in the Thermal Power Air Pollutant Emission Standard set in 2012.

|

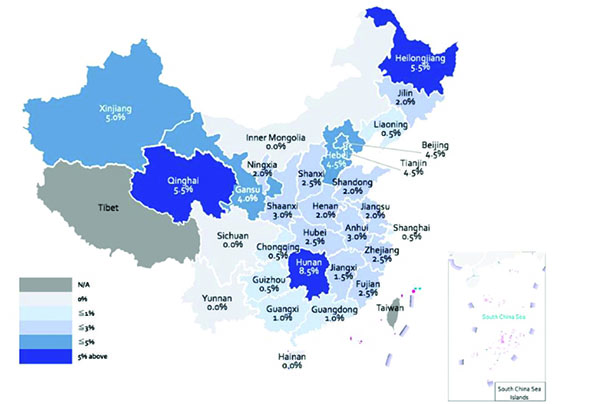

4. Required increases of non-hydro renewables by province in China (2018–2020). Source National Energy Administration |

During 2017, meanwhile, China’s nuclear output increased 16% and hydro rose a modest 1.5%. But wind and solar saw the most significant gains. Though wind curtailments have been fluctuating between 12% and 15%, depending on the region, since 2015, wind power output surged 26%. Solar photovoltaic (PV) curtailments fell from 10% to 6% between 2016 and 2017, even as solar output surged 75%. Yet, at the end of 2017, while thermal power provided 73.5% of China’s total generation, wind provided just 6.6%, and solar only 1.84%. The NDRC’s September draft orders each province to calculate its 2030 non-hydro renewable power indicative target in accordance with the existing national target of 20% non-fossil energy consumption set for 2030 (Figure 4).

The new RPS follows the pivotal rollout by China’s NDRC, the Ministry of Finance, and NEA of the “531” policy at the end of May, which sought to control the breakneck surge of solar PV by phasing out subsidies. The NEA noted that China’s total installed solar PV capacity has reached 150 GW—well beyond the 105-GW national target set for 2020 in the 13th Five-Year Plan. Experts widely projected that the policy would halt work on major solar PV projects. However, over the summer, the NEA reaffirmed that the country will continue supporting solar PV deployment, though it said it will focus on accelerating solar’s price parity compared to coal power, mostly through programs to alleviate poverty and for distributed generation.

While the draft doesn’t limit the total amount of new grid parity wind and solar PV power projects, the government in September also solicited comments on an NEA notice that prohibits wind and solar PV projects from receiving subsidies if they are in a region with very high curtailments—marked as “red”—even if they are at grid parity.

In a separate notice, the NEA also encouraged acceleration of nine direct current and alternating current ultra-high-voltage power transmission projects with 12 lines and a total transmission capacity of 57 GW. The measure seeks to transmit power from the northwest to heavy-load areas in the southwest and east as well as to increase interregional and interprovincial power transmission. The measure could mean that four of the nine projects may be approved later this year, and the other five, in 2019.

—Sonal Patel is a POWER associate editor.

The post China Sets a New Renewable Portfolio Standard appeared first on POWER Magazine.