GE, MHPS Vie for Top Spot in Fiercely Competitive Gas Turbine Market

Credit to Author: Sonal Patel| Date: Thu, 14 Feb 2019 15:05:42 +0000

Mitsubishi Hitachi Power Systems (MHPS) appears to have snagged the lead in an intensifying competition in a mostly flat market for heavy-duty gas turbines of above 100 MW, but GE retained its lead both for overall installed gas turbine capacity and units in 2018, a much-watched industry ranking suggests.

Data from McCoy Power Reports’ latest gas turbine report, released on Feb. 11, suggests GE led the list of major technology owners in total ordered capacity and total ordered units for gas turbines of 10 MW and above. MHPS topped the list for gas turbine orders for units of 100 MW and above, as well as for “post-F” class gas turbine orders.

MHPS, which is a joint venture between Japanese firms Mitsubishi Heavy Industries (MHI) and Hitachi, celebrated the ranking in a Feb. 11 press release. “Being the heavy-duty gas turbine leader in this competitive market is validation of both our world-leading turbine technology and of our employees around the world who put our customer first,” said Kenji Ando, president and CEO of MHPS.

GE, which reported dismal earnings for 2018, owing in part to slack demand for its larger gas turbines, also celebrated the ranking achievement. “While 2018 was a tough year in the global power market, GE was proud to be the leader for both gas turbine capacity and units for 2018, as it has been every year since 2010 according to McCoy Power Reports,” GE told POWER in a statement on Feb. 13.

Two Sides to the Report

McCoy Power Reports says on its website it parses surveys submitted by manufacturers and licensors to relay “a detailed picture of the power gen market. This picture is an education of the most recent trends of project development and can be applied to learn the equipment choices being made by project developers, which technologies are popular or are emerging in the marketplace, future fuel demands, general trends of equipment choices inside certain industries, and many other lines of inquiry.”

The company analyzes 25 to 30 data points for each equipment piece ordered including manufacturer, technology owner, project owner (customer), project owner type, project type, project name, location, fuel, technology utilized, configuration, capacity, capital formation date, operating date, and more. Industry sources suggest, however, that starting in 2019, the reporting agency will require that order volumes for gas turbines of more than 100 MW reported to McCoy be recorded in company financial statements so the ranking will reflect accurate, publicly verifiable information.

POWER asked McCoy for a clarification but McCoy declined to comment, citing client confidentiality. The tweak in criteria, however, points to a possible reporting discrepancy.

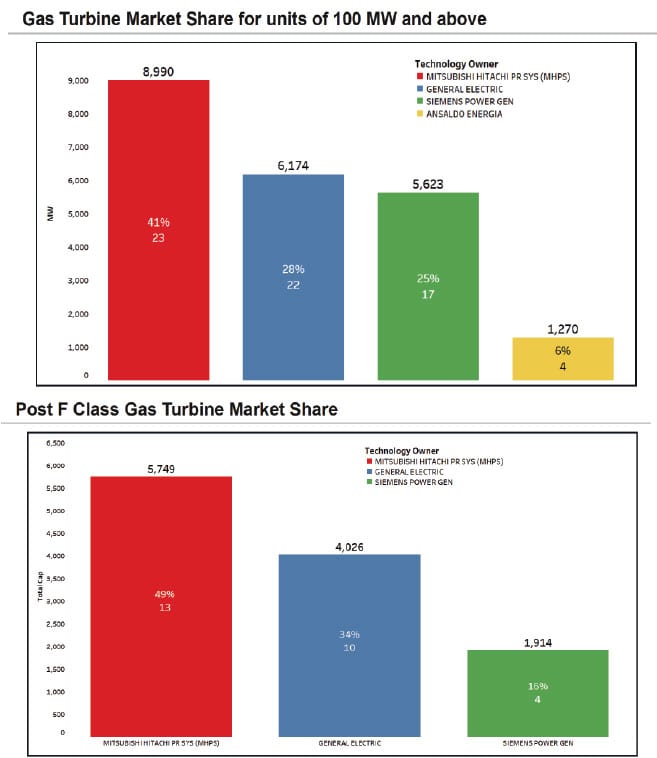

MHPS told POWER on Monday that of 22,057 MW in gas-turbine capacity above 100 MW sold in 2018 by four of the world’s top large gas-turbine makers, MHPS bagged 8,990 MW, taking more than a 40% share of the market. GE followed at 6,174 MW, with a 28% share, and Siemens trailed closely, at 5,623 MW, which is a 17% share. Ansaldo Energia sold 1,270 MW, or 6% of the total. McCoy reportedly recorded 23 units for MHPS, 22 for GE, 17 for Siemens, and four for Ansaldo.

In a comparison of the three largest “post-F” class gas turbine makers, MHPS said it captured a 49% share of total capacity at 5,749 MW, followed by GE at 34% (4,026 MW), and then Siemens with 1,914 MW (16%). McCoy reportedly recorded 13 units for MHPS, 10 for GE, and four for Siemens.

GE’s financial statements show its total gas turbine orders plunged from 75 in 2017 to 43 in 2018, and that it sold 22 units, a total 6.2 GW, for units larger than 100 MW. In third-quarter results reported on Feb. 6, MHI said it received five orders for “large” gas turbines between April and December 2018, and four orders between April and December 2017. MHI’s backlog of gas turbine orders received was 37, as of December 2017, 38 as of March 2018, and 35 as of December 2018.

POWER also reached out to Siemens and Ansaldo but did not receive an immediate response.

A Fine Achievement for MHPS

MHPS said its market dominance in the segment was driven by popularity of its J-series gas turbine, which boasts an efficiency of 64% and a reliability of 99.5%.

MHPS’s key selling point is that “it validates its G-series and J-series turbine technology” at its T-Point validation facility in Japan, but the company also takes an “incremental approach of building upon proven designs to avoid technology leaps,” Todd Brezler, vice president of Marketing at MHPS, told POWER last week.

MHPS, which bagged orders of $13.1 billion in 2017, forecasts sizable demand for advanced-class gas turbines, Brezler said. Owing to their higher efficiency and lower emissions profile, and ability to provide higher output for better project financing, along with improved flexibility, advanced-class gas turbines are an ideal replacement for coal and nuclear capacity, he said.

Since 2014, orders for MHPS steam-cooled J-series, and steam-cooled and air-cooled G-series advanced-class gas turbines have exceeded orders for F-class turbines, it said. In December 2016, it also introduced an “enhanced” air-cooled J-series turbine. Recently, it rolled out the M501GAC “Enhanced Response” gas turbine, which integrates G-series technology and MHPS’s flagship analytics and artificial intelligence technology, TOMONI. Brezler said at least one company, a “leading Midwest utility,” has ordered the “flexible peaking power solution.”

Data from McCoy report sent to POWER by MHPS suggests other large gas turbine models considered by the reporting agency in its ranking include Siemens’ 9000HL, 8000H, and WestinghouseG, and GE’s HA.01, HA.02, and Steam Cooled H.

According to MHPS’s Ando, the ranking shows MHPS’s business choices are moving in the right direction. “Twenty years ago, we made a bet that efficient and flexible natural gas power generation, in combination with renewables, would displace more carbon intensive and expensive forms of power generation. We are now seeing that bet play out before our eyes.”

Ando added: “We have great respect for our competitors, and this makes our accomplishment even more rewarding. I’m proud that more customers are choosing us to provide reliable and efficient power, and I’m looking forward to MHPS continuing to lead a Change in Power.”

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)

The post GE, MHPS Vie for Top Spot in Fiercely Competitive Gas Turbine Market appeared first on POWER Magazine.