PJM Will Hold Capacity Auction Under Current Rules in August

Credit to Author: Sonal Patel| Date: Wed, 10 Apr 2019 21:52:23 +0000

PJM Interconnection said it will hold its 2022–2023 capacity auction under current market rules on Aug. 14, 2019, though the Federal Energy Regulatory Commission (FERC) has yet to issue a decision on the grid operator’s plan to revamp its Minimum Offer Price Rule (MOPR). In an April 10 filing, however, PJM asked FERC to clarify that it will not invalidate the results of the auction with a subsequent order that would require rerunning the auction.

PJM President and CEO Andy Ott on April 10 announced the grid operator will hold the upcoming capacity auction as scheduled, noting certainty in the market is essential, and that PJM is legally obligated to operate under current market rules, which require holding the auction this year. “We’re trying our best to provide a path forward that provides as much clarity as we can,” Ott said at a Market Implementation Committee meeting on Wednesday.

PJM has sought changes to its capacity market owing to concerns that the amount and type of generation resources receiving out-of-market support has increased substantially, evolving beyond small-scale renewables to thousands of megawatts from larger nuclear units. More states in PJM’s 13-state footprint are meanwhile considering providing more support based on an “ever-widening scope of justifications.” These subsidies have a “suppressive effect” on the price of capacity procured by PJM through its capacity market, which is known as the Reliability Pricing Model (RPM), PJM acknowledges.

PJM submitted two alternatives to FERC in April 2018 to address the price-suppressive effects of subsidies. But on June 29, 2018, FERC rejected both approaches in a 3–2 decision, even though it agreed that the capacity market’s integrity and effectiveness has been increasingly and “untenably threatened” by state subsidies for preferred generation resources. While the commission’s majority determined that the existing MOPR renders the grid operator’s tariff “unjust and unreasonable,” it left the issue unresolved.

PJM submitted a new plan on Oct. 2, 2018, that it said strikes a reasonable balance of providing flexible options to companies that are entitled to subsidies while insulating broader regional markets from financial impacts from those subsidy actions. That plan sought to revamp the MOPR to apply across all fuel and technology types to existing and new resources, while offering a unit-specific carve-out option for subsidized resources that don’t want to be limited by the MOPR. PJM’s proposed MOPR also sets a floor price for the capacity auction to prevent generators from artificially depressing the clearing price. “Low clearing prices that are not a result of market forces alone will discourage innovation and investment in new, more efficient generation, which is one of the most important and effective functions of the competitive electricity markets,” noted Vince Duane, senior vice president of PJM’s Law, Compliance, and External Relations arm.

PJM: Certainty Is a Necessity

But FERC has yet to rule on the new plan—and it has no deadline to do so. While reply filings were due in November 2018, FERC was largely expected to rule in January, after which PJM said it would prepare a compliance filing. To give FERC time to approve the plan and allow enough time to implement ensuing rule changes, PJM delayed its next base residual auction for 2022–2023 from May, when it typically holds the annual capacity auction, to August.

On Wednesday, the grid operator said the “ensuing uncertainty has led to a broad discussion among stakeholders about how to proceed, including whether to request yet another auction delay.” PJM’s Ott said stakeholders are free to petition FERC for such an order, but noted FERC would be under no time obligation to respond.

PJM said its decision to hold the upcoming capacity auction under current market rules was made in consultation with the PJM Board of Managers. The plan is also outlined in a filing PJM submitted to FERC on Wednesday.

In the filing, PJM also asked FERC to clarify that it will not invalidate the results of the auction with a subsequent order that would require rerunning the auction. “When establishing RPM, PJM explained, and the Commission recognized, that a forward capacity market would provide the forward price signals to incent investment far enough in advance for such new entry to come in to service by the relevant Delivery Year. To attract capital, new resources rely on clearing an auction to establish the viability of the resource in PJM’s competitive market. Establishing which resources clear the auction in advance provides load-serving entities and their customers predictability in their capacity charges. Knowing which resources have cleared on a forward basis also is important for state standard offer service programs, as the Joint Consumer Advocates pointed out to the Commission just last week,” the filing says.

“It is critical for all market participants—load, supply, states, consumer advocates, PJM, investors, et al.—to have confidence that the outcome of the auction is not subject to change.”

PJM Files Reserve Pricing Reforms

Earlier in April, PJM also filed a proposal with FERC to revamp its energy reserve pricing rules, a measure it said would fairly value resources that play a vital role in the reliability of the bulk power grid. While these reserves help balance generation and demand during times of unexpected generation loss, increase in electricity use or variable output of generation resources like wind and solar, PJM’s current reserve market rules “do not accurately value reserves for their reliability value or drive consistent response when those resources are called upon,” it said.

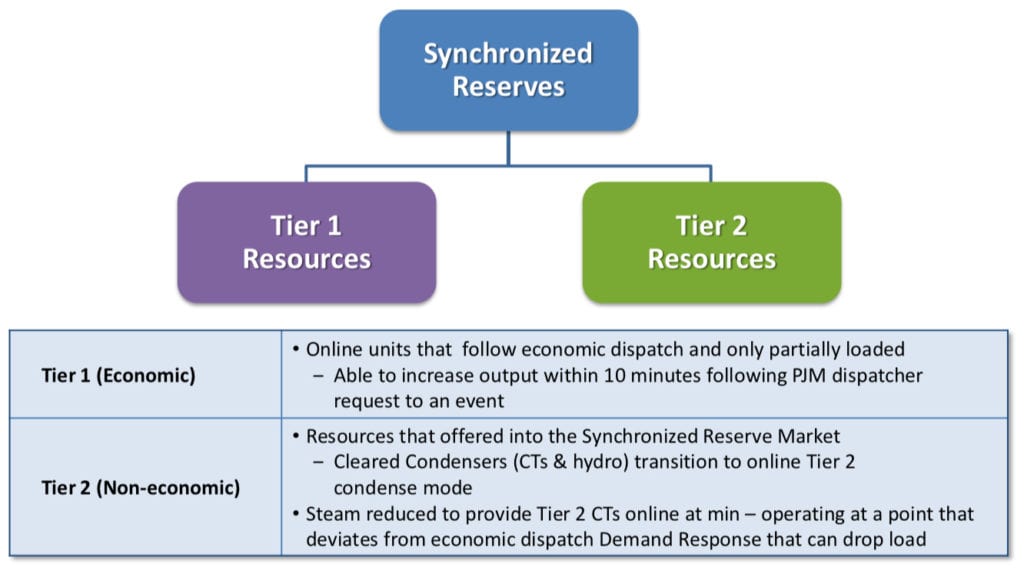

PJM anticipates that 25 GW of wind and 12 GW of solar resources could be added to the region by 2034 if current state renewable portfolio standards are fully implemented. However, the 2019 cold spell provided just one example of the “mismatch between the price and value of needed reserves during stressed times on the grid”—especially for synchronized reserves, which provide power to the grid or remove demand within 10 minutes.

“On Jan. 31, the peak day of the winter season, the Synchronized Reserve Market prices were at or near zero for 19 of 24 hours, suggesting that these important reserves have little or no value,” PJM said. “As the system becomes more dependent on renewable resources, the need for flexibility from all types of resources will increase due to the uncertainties involved in forecasting actual wind conditions and cloud cover on a given day. More effectively valuing this flexibility will allow for the ongoing seamless integration of these resources in the future.”

In its April 1 proposal, which PJM filed under Section 206 of the Federal Power Act—because stakeholders couldn’t reach the two-thirds sector consensus needed on a proposal—the grid operator asked FERC to change the reserve pricing rule to adopt key concepts, which have all been proven successful by other ISOs and RTOs.

A key intent is to ensure prices in the reserve market reflect “the value of operator actions that can then flow to the energy market.” As Stu Bresler, senior vice president of Operations and Markets, noted in press release: “Proper price formation is critical to ensuring that prices reflect the value of the reserves required to operate the system; PJM’s proposal represents a major step forward in the design of the market.”

The proposal seeks to consolidate Tier 1—so-called “economic” reserves—and Tier 2 synchronized reserve products into one product (called “synchronized reserve”); improve utilization of existing capability for locational reserve needs; and align market-based reserve products in day-ahead and real-time markets. It would also raise the reserve penalty to $2,000/MWh from the current $850/MWh price ceiling to ensure utilization of all supply prior to a reserve shortage, and change the Operating Reserve Demand Curves (ORDCs) curve shape for all reserve products based on probabilistic quantification.

PJM Members Are Discussing Carbon Pricing

On March 25, meanwhile, PJM said members of its Markets & Reliability Committee (MRC) have begun discussing whether adjustments to PJM’s market design are necessary on a regional or sub-regional level as more states adopt carbon pricing mechanisms.

New Jersey and Virginia have begun the process of joining the Regional Greenhouse Gas Initiative, and Delaware and Maryland, other states within PJM’s footprint, are already members. According to PJM’s Bresler, PJM already is undertaking detailed modeling and analysis of what carbon pricing could look like throughout the PJM footprint, including its potential impact and revenue stream. In 2017, PJM also released a white paper that analyzed potential carbon-pricing frameworks.

While it is a controversial topic, considerations about carbon emissions pricing are “just reality,” said Michael Borgatti of Gabel Associates, who presented the issue at a March 21 meeting of the Markets & Reliability Committee on behalf of the Independent Energy Producers of New Jersey (which is not a PJM member, but whose members participate in PJM). Borgatti noted PJM and its members could have the opportunity to create a tool to accommodate state policy decisions that are currently being considered.

“This is a discussion that is simply happening now,” he said. “It’s being had whether we want to or not.”

—Sonal Patelis a POWER associate editor (@sonalcpatel, @POWERmagazine)

The post PJM Will Hold Capacity Auction Under Current Rules in August appeared first on POWER Magazine.