2018 Exceptional Year for Nuclear Power Firsts

Credit to Author: Sonal Patel| Date: Thu, 05 Sep 2019 13:18:54 +0000

The post 2018 Exceptional Year for Nuclear Power Firsts appeared first on POWER Magazine.

Last year, five of the world’s 449 operable nuclear reactors reached 50 years of operation for the first time, four first-of-their kind reactor designs were brought online, and while the industry showed capacity factor impacts from load-following, the global nuclear fleet performed at an average capacity factor of about 80%, says a new report from the World Nuclear Association (WNA).

The world’s reactors—a total 397 GWe—produced 2,563 TWh. That’s more than 10% of global electricity demand, and 61 TWh more than in 2017, which means the world’s nuclear generation grew for for the sixth successive year, the Aug. 29-released World Nuclear Performance Report says.

The news is bright for the sector that has been concerned about its future role in a renewables-heavy world. The International Atomic Energy Agency (IAEA) last year said that nuclear power’s share of the world’s power generating mix could shrink dramatically from 10% in 2017 to just 5.6% in 2050 as the industry struggles with “reduced competitiveness.” In advanced economies, it noted, ongoing financial uncertainty and regulatory factors were shuttering aging plants, and declining electricity consumption presented challenges for new reactor construction, which are capital intensive projects.

However, several prominent global organizations, including the IAEA, the WNA, and the International Energy Agency (IEA), note that nuclear has been the biggest low-carbon source of power for more than 30 years. “A sharp decline in nuclear power capacity in advanced economies would have major implications. Without additional lifetime extensions and new builds, achieving key sustainable energy goals, including international climate targets, would become more difficult and expensive,” the IEA said in May, as it released its first report addressing nuclear power in nearly two decades to help bring the topic back into the global energy debate.

The WNA, an international organization that represents the global nuclear industry, keeps track of global nuclear ongoings in a rich fact-based website, information it says is important to contribute to the energy debate, “as well as pave the way for expanding the nuclear business.” Like its website, the annual report provides a detailed fact-based overview of reactor news from around the world.

Following are key insights from the report.

1. Nuclear generation grew in 2018 for the sixth consecutive year.

Following a brief lull in the aftermath of the 2011 Fukushima disaster in Japan, global nuclear generation has been gradually increasing, owing to reactor restarts and new builds. In 2018, nine new reactors were connected to the grid, with a combined capacity of 10.4 GWe. Seven others were closed, with a combined capacity of 5.4 GWe.

Of the reactors that were closed, four were Japanese reactors that hadn’t generated power since 2011, and a fifth, Chinshan 1 in Taiwan, had not generated since 2015. Other permanent shutdowns include Exelon’s Oyster Creek—the oldest operating U.S. plant—and Leningrad 1 in Russia. Seven of the nine reactors connected to the grid in 2018 were in China—including first-of-their-kind AP1000s at Sanmen and Haiyang, first-of-their-kind EPRs at Taishan, and the first third-generation ACPR-1000 reactor at Yangjiang 5. Two others were built in Russia I (Leningrad II-1—the first VVER-1200—and Rostov 4). “Notably the second units at Haiyang and Sanmen had significantly shorter construction periods, demonstrating that even second units can benefit from experience of the first unit’s construction,” the report says.

The nine reactors that began construction in 2018 are: Akkuyu 1 in Turkey, Hinkley Point C-1 in the UK, Kursk II-1 in Russia, Rooppur 2 in Bangladesh, and Shin Kori 6 in South Korea. Three of the new construction projects are Russian-built VVER reactors.

2. Global average capacity factors are down slightly, demonstrating a new, important trend.

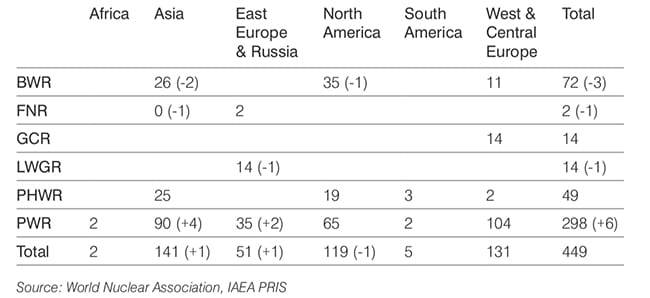

The world’s reactor fleet was dominated by pressurized water reactors (PWRs), followed by boiling water reactors.

Operable nuclear power reactors at year-end 2018 Courtesy: WNA, World Nuclear Performance Report 2019

The fleet’s capacity factor—calculated on the basis of their performance when operational—was 79.8% in 2018, down from 81.1% in 2017. “Despite this small reduction, this maintains the high level of performance seen since 2000 following the substantial improvement over the preceding years. In general, a high capacity factor is a reflection of good operational performance,” the WNA noted. However, the organization noted an “increasing trend” in some countries for nuclear reactors to operate flexibly, in load-following mode, which reduced the overall capacity factor.

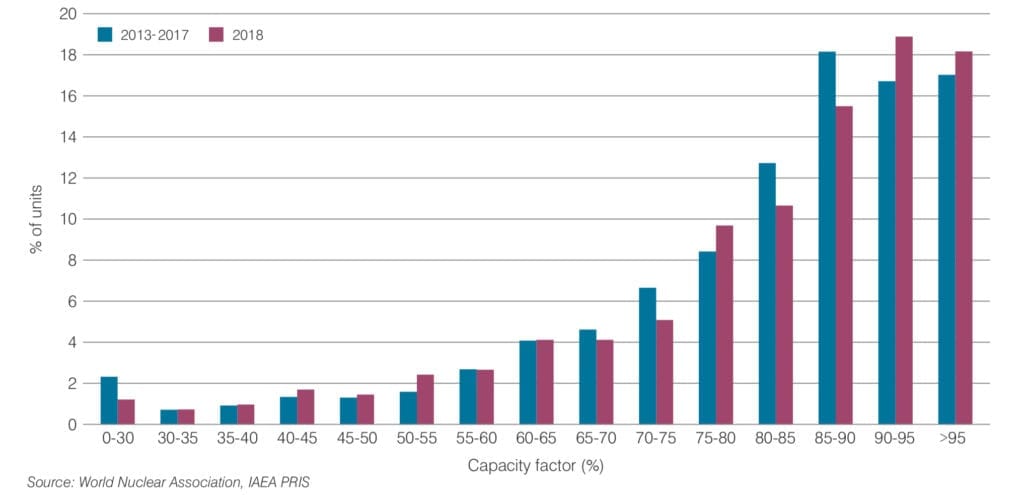

Percentage of units by capacity factor. Capacity factors in 2018 compared to the previous five years are broadly similar, reflecting the consistently high capacity factors seen over the past 20 years. There is a smaller percentage in the 80-85% capacity factor category, and a greater percentage in the categories between 65% and 80%. This may reflect the increasing use of nuclear generation for load-following activities, the WNA said. Courtesy: WNA, World Nuclear Performance Report 2019

The WNA pegged the fleet’s good overall capacity factors to “substantial improvements” in the 1970s through 1990s. “Whereas nearly half of all reactors had capacity factors under 70%, the share is now less than one-quarter. In 1978 only 5% of reactors achieved a capacity factor higher than 90%, compared to 33% of reactors in 2018,” it noted.

3. The fleet showed no significant age-related performance lapses though it grew older.

Significantly, the WNA also said that there was “no significant age-related trend” in nuclear reactor performance. That’s important because in 2018, while the average age of the nuclear fleet was about 30 years, five reactors celebrated 50 years of operation, a milestone never achieved by any reactor worldwide. These reactors include: Beznau 1 in Switzerland, Nine Mile Point 1 and R.E. Ginna in the U.S, and Tarapur 1 and 2 in India. The 1969-opened Tarapur 1 currently holds the title as being the oldest operating nuclear reactor in the world.

4. Construction timeframes for new reactors grew longer.

“One remarkable characteristic of 2018 was the prevalence of new reactors designs amongst the reactor start-ups. Haiyang 1&2 and Sanmen 1&2 were the first four AP1000s to begin operation, Taishan 1 was the first EPR, Leningrad II-1 was the first VVER-1200 and Yangjiang 5 the first ACPR-1000,” the WNA noted. That partly explains why construction time averaged longer in 2018 than those achieved in recent years. The median construction time in 2018 for a new reactor was eight-and-a-half-years, compared to average times in recent years of about five-to-six years. “We should see construction times return to more typical recent durations in 2019,” noted WNA Director General Agneta Rising in the preface of the report.

Median construction times for reactors since 1981. Courtesy: WNA, World Nuclear Performance Report 2019

5. The outlook isn’t so bright in ‘mature’ markets.

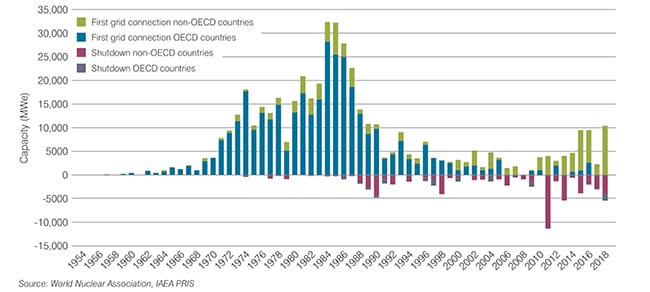

The WNA noted that a number of factors—both internal and external – “are creating profound challenges for nuclear power in some of its most mature markets.” More than half of the world’s 449 reactors were in the U.S. and Europe, where “despite the vital importance of nuclear to achieving sustainable energy goals, reactor retirements continue to outpace capacity additions.”

Capacity of OECD and non-OECD first grid connections 1954-2018. Courtesy: WNA, World Nuclear Performance Report 2019

Already in 2019, eight reactors have been shut down, five in Japan (Genkai and Daini 1-4), one in Taiwan (Chinsan 2), Bilibino 1 in Russia, and Pilgrim 1 in the U.S. Only four new connections have been made to the grid: Shin Kori 4 in South Korea, Novovoronezh II-2 in Russia, and Taishan 2 and Yangjiang 6 in China.

The report outlines a list of developments that indicate a general long-term slowdown for the sector in developed countries. WNA’s Rising pointed to threats “from distorted and challenging market conditions” for some of these developments.

For example, while France postponed plans to reduce nuclear power’s share in its generation mix from 75% to 50%, Germany is pushing forward with a nuclear phase-out, though its seven operational reactors are frequently operating in load-following mode. In the U.S., “despite its laudable operational performance,” cheap natural gas and a proliferation of renewables have rendered reactors uneconomic, and some of the country’s largest nuclear generators have sought—and won—state support in Illinois, New York, Connecticut, New Jersey, and Ohio to keep reactors on the grid.

In Japan, though the country wants nuclear to make up 20% of its energy supply by 2030, restarts have been slow. In Canada, where 10 of its 19 reactors are slated to undergo refurbishment to extend their operating lifetimes by up to 35 years, the government is also pushing accelerated deployment of small modular reactors (SMR), the WNA noted.

6. Majority of new startups are in non-OECD countries.

The majority of reactor capacity built between 1970 and 1990 were in West and Central Europe and in North America. Since that period the majority of reactor startups have been in Asia, with first grid connections in East Europe and Russia also contributing to new global capacity, the WNA noted.

At the beginning of 2019, China had 46 operable nuclear reactors, connecting a record 8.3 GWe of new nuclear capacity—“the second largest annual increase achieved by any country since the advent of civil nuclear power,” the report notes. In India, seven reactors were under construction at the start of 2019—a combined capacity of 4.8 GWe—and it has plans to build many more. In January 2019, “the country’s minister of state for the Department of Atomic Energy and the Prime Minister’s Office told parliament that the country planned to bring 21 more reactors online by 2031. The 21 units will be a mix of indigenous and imported reactor designs,” the report says.

Plans to build new reactors are also underway in Bulgaria, which is looking for investors to restart construction at the stalled Belene project; Poland; Egypt; and Saudi Arabia. Argentina just brought online the Embalse nuclear power plant following three-year upgrade program, and in Brazil, the government is working to extend Angra 1’s lifetime to 60 years while considering resuming construction at Angra 3.

7. The WNA has set a ‘Harmony’ Goal Calling for 25% of the world’s power mix to come from nuclear by 2050.

In December 2018, the WNA rolled out the “Harmony” program, a global initiative of the nuclear industry that “provides a framework for action, working with key stakeholders so that barriers to growth can be removed.” The seeks to generate 25% of the world’s electricity by 2050—which would mean the world will need to build 1,000 GWe of new nuclear capacity over the next 30 years. “This is an ambitious target, but the rate at which new reactors will have to be built is no higher than what has been historically achieved,” it said.

“To achieve this, new nuclear capacity added each year would need to accelerate from the current 10 GWe to around 35 GWe for the period 2030-2050. Those countries operating nuclear power plants should commit to continue to do so and those countries with recent experience of new nuclear build should commit to a rapid expansion of their construction programmes to deliver significant new nuclear construction from 2025,” the WNA added.

Nuclear generation can be expanded fast enough to combat climate change, it suggests. “During the rapid expansion of nuclear generation in France in the 1980s and 1990s, most reactors were built in six to seven years. In recent years in China, nuclear reactors have been frequently constructed in around five years,” it said.

However, it will take a “commitment to a substantial expansion of nuclear generation would deliver the benefits of series construction, including faster and lower cost construction,” the WNA acknowledged.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine)

The post 2018 Exceptional Year for Nuclear Power Firsts appeared first on POWER Magazine.