Regulators: Central Station Generation Will Stay Dominant Despite Emerging Tech

Credit to Author: Sonal Patel| Date: Thu, 21 Nov 2019 15:39:32 +0000

The post Regulators: Central Station Generation Will Stay Dominant Despite Emerging Tech appeared first on POWER Magazine.

A nationwide survey of state utility commissions suggests regulators are increasingly grappling with issues that could “profoundly” alter energy delivery and utility business models. However, over the next decade, they expect central station generation will continue to dominate state portfolios, and utility-scale solar growth will surpass customer-owned photovoltaic (PV).

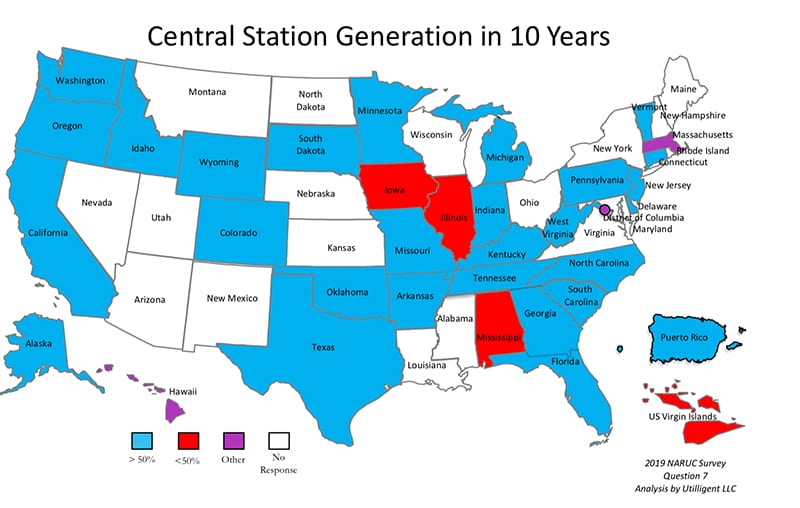

The survey to take the “regulatory pulse” and gauge key electricity planning issues currently facing public commissions was put to all U.S. states by the National Association of Regulatory Utility Commissioners (NARUC) in partnership with management consulting firm Utilligent, between March and May 2019. All states are members of NARUC. The agency said its analysis, which it unveiled on Nov. 19, was based on responses from 37 commissions: Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kentucky, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Jersey, North Carolina, Oklahoma, Oregon, Pennsylvania, Puerto Rico, South Carolina, South Dakota, Tennessee, Texas, U.S. Virgin Islands, Vermont, Washington, West Virginia, and Wyoming.

The survey provides much-needed regulatory insight on pressing issues that utilities face today and in the near future. As experts have noted, the energy transition is unfolding rapidly, driven in large part by state clean energy and climate policy goals, even though these sometimes infringe on wholesale electricity markets, which are largely overseen by the Federal Energy Regulatory Commission (FERC).

“Policy and cost are the primary drivers for change, regulations can be the brakes or the accelerator, according to responses from the commissioners,” explained Utilligent Executive Vice President of Strategy and Transformation Meir Shargal, who authored the survey analysis with Roy Ellis, the group’s practice lead for digital grid and policy. “Looking at the issues facing the industry through the eyes of those who must regulate them is an excellent way for stakeholders to think about the range of possibilities.”

Dominance of Central Generation

Among the survey’s critical findings are that while some states have seen a surge in distributed generation (DG), central station generation—which it defines as facilities of all fuel types, including fossil fuels, nuclear, hydro, wind, and solar, that are “large-scale, require transmission support, require significant investment and are deployed to fill a long-term generation need with a corresponding revenue stream”—is “not going away anytime soon,” either in regulated or deregulated electric markets, and regardless of fuel.

One reason for this is costs: “While much could, and probably will, change in 10 years, it’s doubtful that DG can, or will, achieve the economies of scale found in the central station approach, even if both approaches are mostly renewable in nature,” it says. “If the goal is cleaner and greener, regardless of generation ownership, then central station may be the better means to achieve that goal, especially if prices for renewables are as low or lower than fossil generation options.”

The authors cited Hawaii as a “excellent case study,” noting that the state has a legislative mandate to achieve 100% renewable by 2045. Though the state sourced 10% to 12% of its power from DG in 2018, that share trended down since the closing of net metering, and the state responded that to meet interim targets it will rely largely on the growth of renewable central station generation to displace oil and coal generation. “The long-term resource plans anticipate roughly 50% from central station and distributed generation. It is hard to estimate if we will reach this in 10 years but anticipate significant growth in both central station and distributed renewables as fossil generation is retired in next 5 years,” the state responded.

NARUC and Utilligent asked state utility commissions if and how they anticipated changes for central station generation over the next decade. Their responses suggest central generators will remain a key contributor to the power mix in most states, regardless of fuel. Source: NARUC 2019 Survey: Distributed Energy Resources, Energy Efficiency, Demand Response, Digital Grid, and Central Station Generation.

What it means, the authors posited, is that for deregulated states, large-scale third party generators will remain relevant for at least the next decade. “For states with vertically integrated utilities the value of the utility as the owner of generation, even beyond fossils, is also apparent, at least for overall residential supply.”

Over the next five years, meanwhile, though the survey suggests installed solar capacity will increase on both sides of the meter, the supply side will show an overall percentage of growth advantage. “For example, Colorado projects a 275% increase on the supply side and 85% increase on the demand side, while Florida projects a 500% supply-side and a 300% demand-side growth. Illinois projects ‘significantly’ higher than 40% growth on both sides of the meter, while North Carolina projects greater than 70% growth on the supply-side and 11-20% on the demand side,” it says. A certain driver behind the five-year increase involves “the race to take advantage of disappearing Investment Tax Credits (ITC), but the increasingly competitive nature of solar, even without the ITC, could bode well for long-term growth,” it adds.

A significant driver for behind-the-meter growth is net metering. “Overall, the survey respondents show that net metering has succeeded, but as California, Arizona, and Hawaii demonstrate, some states are moving away from binary solutions to more market-informed tariffs.” Looking over the next 10 years, time and location of generation and consumption will become increasingly important. “Ultimately it will be market-driven signals (price) that should and will drive the distributed generation market.”

High Expectations for DERs

Still, distributed energy resources (DERs), assets that can provide supply, demand, and ancillary grid services from the edges of the grid, “are becoming mainstream in regulatory and industry thought, if not yet fully deployed realities,” the authors suggested.

A concerted focus involves battery storage, the cost of which in 2019 declined 76% since 2012, and for which federal regulatory efforts, including FERC’s February 2018-issued Order 841, could expand market opportunities.

“The the extent to which storage can firm intermittency (and serve as both supply and demand) is probably the wildcard in this evolution, creating a driver that may influence both policy and penetration,” they noted. “While policy or necessity (or both) have driven penetration rates where they are highest, the potential of distributed resources is causing the overall industry to consider their inclusion for a variety of reasons. These fundamental improvements are likely to introduce long-term changes to energy generation and delivery that may well require changes to the utility business model. These industry-wide improvements will lead to new policies and regulations that will reshape the industry.”

However, the survey shows a disconnect between customer expectations and grid investments. As it notes, nearly 90% of the the survey’s respondents said that commissioners understand the correlation between DER penetration and grid investment needs—but slightly less than 90% of the commissioners said they believe “customers do not understand this correlation.”

Resilience Emerging as a Major Driver

Notably, most commissions responded that they consider the ability to manage demand and provide distributed supply to be viable components for use in resilience planning. But while some states have included DERs in formal planning activities, other states noted that integrated resource planning (IRP) and distributed resource planning (DRP) were still maturing, and could include DERs in resiliency planning in the future.

However, the analysis notes: “We found overwhelming support for inclusion of DERs for resilience, not just reliability, although these two concepts are conflated. In most states, legislative and regulatory activities are underway to create or refine laws and regulations that increase the opportunity for DER participation. The word resilience is mostly indistinguishable, at this point, from the policies goals associated with the concept of reliability. Resilience like reliability is ultimately about making sure the lights are on. Answers to this survey question suggest that regulators recognize that DERs will increasingly contribute to that goal.”

Another major issue faced by state regulators concerns how to value and regulate local services—such as capacity, energy, and ancillary services—in wholesale markets. For example, some states are grappling with how to put the brakes on increasing levels of DER penetration to avoid circuit overload and cost shifting, while still encouraging DER growth. One effort to tackle that issue involves DER locational valuation. That concept is under development, at varying stages, at commissions in California, Connecticut, Hawaii, Idaho, Illinois, Minnesota, Oregon, and the U.S. Virgin Islands, the analysis notes.

Significantly, most respondents also agreed that cost-shifting is an emerging issue. Asked if load reductions owing to DERs, energy efficiency, and demand response was resulting in general rate increases, many respondents said “yes,” but noted they had no mechanism to address the issue. “This issue could lead to a more holistic approach to cost shifting that results in a true value of a DERs model and an agreement on what grid and operating costs are unavoidable,” the analysis noted. “This issue could be the next big regulatory thing, thanks in no small part to battery storage.”

Federal and State Tensions

According to the survey, about 60% of respondents said they either have long-term planning processes in place or are in the process of implementing them. “Many of these resource plans are expanding the traditional generation, transmission and distribution planning processes to include transparency and regulatory oversight,” the analysis notes, and some even seek to ensure long-term investment include state resource priorities.

However, responses to a survey question about whether states anticipate growing tension with the federal government suggest states worry that their policies may be stymied by federal authority. While most respondents, for example, agreed that a coordinated national response is appropriate for cybersecurity, demand response, storage, and ancillary services participation in the wholesale market, overseen by FERC, is an emerging concern.

Source: NARUC 2019 Survey: Distributed Energy Resources, Energy Efficiency, Demand Response, Digital Grid, and Central Station Generation.

FERC Order 841 is proving to be contentious, the states noted. California responded, for example: “To the extent that DERs participate in wholesale markets, and behind-the-meter resource providers and customers seek to earn revenues in both wholesale and retail markets, future proceedings at CPUC or FERC could seek to draw bright lines that may or may not comport with state/federal policy directions.”

Another area involves interconnection queues and transmission costs. Despite FERC Order 845, as North Carolina explained in its response, “… generation in the FERC queue creates delays for processing projects in the State queue. Similarly, there will be tensions regarding who pays for transmission upgrades.”

Murky Decisions About Digitalization and Transport Electrification

Compounding regulatory complexity, meanwhile, is that state commissions also grapple with a general lack of detailed data that would help them make informed decisions. “A true bulk power system view does not exist in the US,” the analysis notes. “A significant amount of the necessary data to understand where DERs might be deployed most successfully, is probably captured today, but provision of that data is not yet standard practice and analysis of that data for DER valuation is certainly not possible without the necessary technology.”

Several states appear to be taking steps to address this knowledge gap by integrating technology tools, but investments in technology such as DER management systems may not be fully justified until DER penetration or legislative urgency ramps up. Data privacy is also a key concern, commissions said.

Meanwhile, most commissions haven’t yet considered capital treatment for cloud computing. “Those who are considering are the ones trying to work within or around the traditional utility business model to develop incentives for change that address utility business concerns. Increasingly, grid software and the expertise required to manage and update it will be remote, cloud-based and cheaper than internally developed and/or deployed technology. This may not matter to most regulators today, but it may in the future,” the analysis says.

As interestingly, accelerating the pace of electric vehicle (EV) and rollout of public charging infrastructure is clearly of interest to state commissions, but most are still developing policy—to provide regulatory direction and market incentives—and implementing pilots to refine regulatory, technical, and market needs.

As the analysis concludes that on the question of transport electrification: “The most interesting takeaway is that most Commissions have made no decision on the appropriate role for the utilities. Combine what we learn here … with EV charging, and the pattern is clear. Some core, policy decisions are required, but many states are waiting for penetration rates to increase, along with customer demand for charging infrastructures.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine)

The post Regulators: Central Station Generation Will Stay Dominant Despite Emerging Tech appeared first on POWER Magazine.