This Company Makes Millions Running Canada’s Student Debt Program

Credit to Author: HG Watson| Date: Wed, 18 Dec 2019 10:30:00 +0000

If you are a Canadian student in college or university, there’s a good chance you’ve gotten very familiar with the Canada Student Loans Program.

It’s there when you first apply to get the precious funds that enable you to go to university, and when you call about repayment assistance for the likely thousands of dollars of debt you accrued. (These days, the average graduate of an undergrad program in Canada leaves school with a government-issued loan balance of just over $16,000.)

But what you might not know is that the federal government outsources student loan operations to a privately-held corporation—and they are making money. A financial tech company called DH Corporation oversees just about every part of the Canada Student Loans Program, except for applications and eligibility assessment. When you receive a letter or email about your student loan, it’s actually coming from DH Corp.

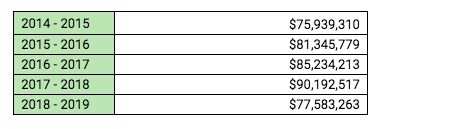

Data provided to VICE Canada by Employment and Social Development Canada shows that DH Corp., which was part of the merger that formed the larger financial technology company Finastra in 2017, has been paid eight-figures yearly by the federal government for administering the Canada Student Loans Program.

DH Corp.’s payments are tied to the number of students receiving both loans and grants through the Canada Student Loan Program and Canada Student Grant Program, respectively, and the integrated federal-provincial loans of Ontario, Saskatchewan, New Brunswick, Newfoundland and Labrador and British Columbia. (Since 2016, Finastra/DH also had separate contracts with Prince Edward Island, Nova Scotia, and Alberta to run their provincial loan programs.)

An ESDC spokesperson told TVO.org the DH contract's fee structure "is based on specific fees for services offered by DH Corp. for each borrower currently in the programs… As a result, when the number of student loan borrowers enrolled in the Canada Student Loans Program and/or provincial programs increases, resulting in higher workload, the fee paid by Canada to DH Corp. also increases.”

A spokesperson for ESDC told VICE Canada that the numbers dropped slightly between 2017-2018 and 2018-2019 because “the contract between the government and DH was renegotiated and included a one-year extension, and a reduction in the account fees for 2018-19.” A second contract also includes “the design, development and implementation of a new service delivery model.” This new system replaces a paper-based admin model.

Since 2017, Finastra has been a privately owned company that does not have to release quarterly or year-end reports. However, a 2015 DH Corp. annual report called its contract with the federal government “significant.” That year, the company’s total revenue from lending solutions in Canada, including collateral management solutions, mortgage origination, and student lending, was over $367 million.

Over the past 25 years, federal funding to universities has dropped. A 2016 Canadian Centre for Policy Alternatives paper found that government funding dropped from over 77 percent in 1992 to less than 55 percent in 2012. Schools have had to make that up by raising tuition, creating a situation where many students can’t afford the full cost of classes.

Erika Shaker, director of education and outreach at the Canadian Centre for Policy Alternatives, said that as a system becomes more complicated it becomes less adequate for many. “You have a program that ostensibly was supposed to be publicly funded, and then you start making it less and less publicly funded and then you say, ‘oh crap, it's actually making it inaccessible for portions of the population who have been traditionally marginalized and are more vulnerable. And this is just going to make things worse,’” she said. “What we've done is we've actually created a sieve rather than saying, you know what, let's actually address affordability and accessibility at the outset.”

During the 2016-2017 school year, over 490,000 Canadian students took out $2.6 billion in student loans across the country. A further 380,000 received $1 billion in grants. And with those loans comes more debt—the total amount of outstanding loans is over $18 billion.

Sofia Descalzi, the chairperson of the Canadian Federation of Students, said that it is important that the government be transparent about how the CSLP program is operated because it could also illuminate a way to making education more affordable. “Why is this such a problem that we can not work towards a system that, instead of the money going to a private company, [is] going to people by providing grants, by decreasing loans, by increasing funding to universities and colleges to reduce and eliminate tuition fee.”

An ESDC spokesperson said that DH Corp. is not involved in any way with the application process or with eligibility assessment for student aid, which is done by the provinces.

DH Corp.’s current contract with the federal government will expire in 2026.

Follow HG Watson on Twitter.