EIA: Renewables Will Surge to 22% of U.S. Power Mix in 2021

Credit to Author: Sonal Patel| Date: Thu, 16 Jan 2020 14:27:33 +0000

The post EIA: Renewables Will Surge to 22% of U.S. Power Mix in 2021 appeared first on POWER Magazine.

The U.S. Energy Information Administration (EIA) in its first forecast for 2021 suggests the share of renewables in the utility-scale U.S. power generation mix will surge to 22%, up from 17% last year, while coal and nuclear’s shares will be further diminished.

According to the agency’s latest Short-Term Energy Outlook (STEO), released Jan. 14, coal’s share of U.S. power generation—which was 46% in 2010—was just 24% in 2019, and will fall to 21% this year and in 2021. Nuclear’s share, which averaged slightly more more than 20% in 2019, will fall to slightly less than 20% in 2021, consistent with upcoming reactor retirements.

Generation from natural gas-fired plants will remain steady at 37% compared to 2019, but after nearly a decade of growth (it held a 23% share in 2010), it will fall a percentage point in 2021 compared to 2020. That’s despite EIA projections that Henry Hub natural gas spot prices will average $2.33 per million British thermal units (MMBtu) in 2020, down from $2.57/MMBtu in 2019. In 2021, prices will hike up again to $2.54/MMBtu in 2021 owing to falling natural gas production, the EIA suggests.

Gas Consumption Will Slow

In 2019, consumption of natural gas for power generation surged 7% to 31.0 billion cubic feet per day (Bcf/d) in 2019 compared to 2018, owing to new capacity and competitive prices, the EIA noted. This year, however, natural gas power generation consumption will slow, increasing only 1.3% compared to 2019. In 2021, it will decrease 3.2%. “Declining power sector consumption in 2021 reflects increased competition from renewable sources of electricity generation as a result of continuing renewables capacity additions. Declining natural gas consumption also reflects a forecast of higher natural gas spot prices in 2021 compared with 2020, which would make natural gas less competitive against coal in power markets,” says the EIA.

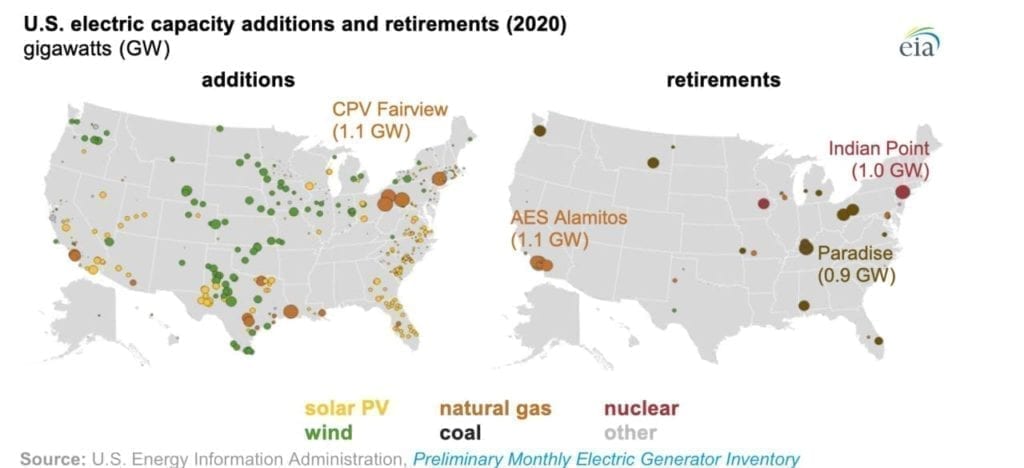

According to the agency’s latest inventory of electric generators, of 42 GW of new capacity additions expected to begin commercial operation this year, 32 GW–or 76%—will be wind and solar resources.

Wind will dominate new capacity additions; about 18.46 GW will be added to the grid this year, surpassing a record level of 13.2 GW set in 2012. Meanwhile, 13.48 GW of solar will come online, also breaking the previous record of 8 GW, which was set in 2016. More than half of the utility-scale electric power sector solar photovoltaic (PV) capacity additions will be in four states: Texas (22%), California (15%), Florida (11%), and South Carolina (10%).

The residential and commercial sectors will also experience record growth as a result of new distributed PV or rooftop systems, the IEA said. Those additions compare to 9.31 GW of natural gas that is expected to be added to the grid this year. Combined-cycle plants account for 6.7 GW and combustion-turbine plants account for 2.3 GW. More than 70% of these additions are in Pennsylvania, Texas, California, and Louisiana.

Coal Retirements Continue

More coal retirements—up to 5.8 GW—are also expected this year, half of which will be in Kentucky and Ohio. The retirement of Unit 3 at the Paradise plant in Kentucky (0.97 GW) will be the largest coal-fired unit to retire in the United States this year. The next-largest retirements will be at Elmer Smith in Kentucky and at Conesville (Unit 4) and W H Sammis (Units 1-4) in Ohio, the EIA said.

About 3.7 GW of natural gas capacity—mostly older steam turbine plants built in the 1950s and 1960s—will be retired this year. At least 2.2 GW will be California plants, including AES’s Alamitos, Huntington Beach, and Redondo Beach plants. Among notable gas retirements this year is the 10-year-old, 700-MW Inland Empire Energy Center, a single-shaft combined cycle plant, because it has been operating below capacity for several years. The plant is notable because it was only one of six H-System plants built by GE before the company introduced its HA models.

Meanwhile, two nuclear plants totaling 1.6 GW are currently scheduled to retire in 2020. Indian Point Unit 2, in New York, will retire in April. Iowa’s only nuclear power plant, Duane Arnold Energy Center, is set to retire in December.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine)

The post EIA: Renewables Will Surge to 22% of U.S. Power Mix in 2021 appeared first on POWER Magazine.