SEC’s Landmark Climate Disclosure Rule Weighing on Power Sector

Credit to Author: Sonal Patel| Date: Thu, 24 Mar 2022 16:17:35 +0000

Investor-owned electric companies are thoroughly reviewing the Securities and Exchange Commission’s (SEC’s) broad new proposed rule that requires registrants to disclose climate-related risks and governance, and plan to remain engaged with the regulatory agency as the rulemaking continues.

The proposed rule, which the SEC approved 3–1 on March 21, has drawn intense interest from the energy industry owing to its potential mandate that companies disclose in annual 10-K reports how any climate risks could have short- and long-term material impacts on businesses and consolidated financial statements, and if any climate-related risks have affected company strategies, business models, and outlooks.

In addition, if finalized, the rule could require companies to disclose processes for identifying, assessing, and managing climate-related risks, including climate-related risk management strategies, and “relevant metrics and targets” related to their management of any physical and transition risks.

Among the proposed rule’s broad purview are disclosures on how companies perceive climate-related events—including severe weather events and other natural conditions—could affect bottom lines. Additionally, the proposed rule requires disclosures of Scope 1 and 2 greenhouse gas (GHG) emissions. Under the “scope”–oriented benchmarks set by the Greenhouse Gas Protocol, Scope 1 is defined as direct emissions from the company, while Scope 2 emissions are indirect emissions from power the company purchases from others to use in its facilities.

The proposed rule, meanwhile, will also require Scope 3 disclosures—which include indirect emissions that arise from other sources in the company’s value chain—if “material” or if a company has set a GHG emissions target or goal that includes Scope 3 emissions. Companies—like Duke Energy—that have publicly set climate-related targets must also disclose information about how they intend to meet climate-related targets or goals, including net-zero ambitions.

The SEC’s adoption of the proposed rule kicks off rulemaking procedures that will include a 30-day comment period after publication in the Federal Register. SEC staff suggested the proposed rule could be adopted with an effective date in December 2022.

At Issue: Standardized, ‘Reliable’ Climate Risk Information for Investors

Three of the SEC’s four commissioners on Monday lauded the SEC staff proposal as a necessary mechanism that would give investors more “consistent, comparable, and reliable information” about how companies are addressing climate-related risks.

“The proposed rules are intended to enhance and standardize climate-related disclosures to address these investor needs. Many issuers currently seek to provide this information to meet investor demand, but current disclosure practices are fragmented and inconsistent,” the SEC staff argued in a fact sheet. “The proposed rules would help issuers more efficiently and effectively disclose these risks, which would benefit both investors and issuers.”

In an impassioned dissent, Commissioner Hester Peirce, however, warned the broad scope of mandated disclosures would undermine the existing SEC regulatory framework, which is based on a “materiality principle,” and subject it to a “one-size-fits-all prescriptive framework.” While she noted that several companies already prepare sustainability reports and post them on websites, the “Commission proposes today to require companies to pull into Commission filings much of this non-investor-oriented information that is either immaterial or keyed to a distended notion of materiality that seems to turn on an embellished guess at how the company affects the environment.”

Ultimately, asking companies to provide “comparable, consistent, and reliable” climate information in their SEC filings is unrealistic, Peirce argued. “The proposal does not just demand information about the company making the disclosures; it also directs companies to speculate about the habits of their suppliers, customers, and employees; changing climate policies, regulations, and legislation; technological innovations and adaptations; and changing weather patterns,” she said. “Wanting to bring clarity in an area where there has been a lot of confusion and greenwashing is understandable, but the release mistakenly assumes that quantification can generate clarity even when the required data are, in large part, highly unreliable.”

Peirce added: “Requiring companies to put these faulty quantitative analyses in an official filing will further enhance their apparent reliability, while in fact leaving investors worse off, as Commission-mandated disclosures will lull them into thinking that they understand companies’ emissions better than they actually do.”

Peirce also notably argued that the proposed rule may be outside the SEC’s statutory limits and raises fundamental constitutional First Amendment questions. Noting that the SEC’s mission is to protect investors, facilitate capital formation, and foster fair, orderly, and efficient markets, the proposal “steps outside our statutory limits by using the disclosure framework to achieve objectives that are not ours to pursue and by pursuing those objectives by means of disclosure mandates that may not comport with First Amendment limitations on compelled speech,” she said. “We would do well to heed the admonition of the Supreme Court in a case involving the [Environmental Protection Agency (EPA)] Congress charged with regulating the environment,” she said.

Power Industry Facing Multiple Transition Risks

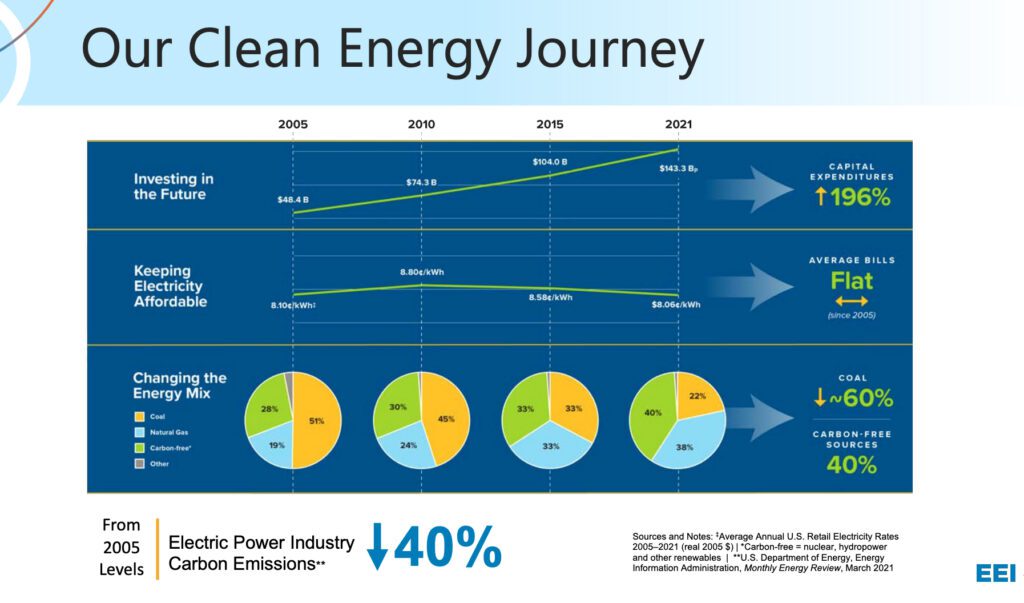

For the power industry, the SEC’s proposal adds another element of regulatory burden related to climate change and the energy transition. But though the power sector initially pushed back against sharp-edged power plant GHG regulations from the EPA (a legal battle which continues at the Supreme Court), the sector has, for the most part, embraced the energy transition toward a low-carbon future.

One reason is that it wants certainty. As the Edison Electric Institute (EEI), a trade group that represents all U.S. investor-owned U.S. utilities, recently opined in an amicus brief at the ongoing GHG case at the Supreme Court: “While it may seem counterintuitive that the nation’s investor-owned electric companies, in particular, should favor EPA regulatory authority, the alternative could be the chaotic world of regulation by injunctive fiat.”

But as POWER this year reported in detail, the energy transition is ramping up an overall system complexity, and the power sector is now facing a lengthy list of looming exposures. Along with natural disasters, the sector is precariously balancing reliability requirements with environmental compliance requirements. That is compounded by unprecedented regulatory uncertainty, a changing customer base, and inherent technology, workforce, supply chain, and cybersecurity risks. Recent events have meanwhile highlighted risks associated with fuel uncertainty, business model overhauls, asset divestment, and decommissioning, safety, and geopolitical concerns.

Without a standardized climate-risk framework in the U.S., investors have so far navigated the transition informed by environmental, social, and governance (ESG) metrics to gauge corporate sustainability. Shareholder activism has prompted crucial changes in company strategies, and in some cases, it has pushed financial institutions—including banks, insurers, and brokers—to halt financial support or coverage for the traditional coal-fired power sector.

Recognizing investor concerns, investor-owned power companies represented by EEI in 2018 rolled out an official industry-designed ESG sustainability reporting template to help utilities better inform investors about ESG initiatives. In May 2021, EEI and the American Gas Association (AGA) released a third version of the template, enhancing the template’s focus on diversity, equity, and inclusion, and “more uniform disclosure” of long-term climate goals. Forty-three investor-owned electric companies have used the templates for their sustainability websites.

Edison Electric Institute (EEI) member company environmental, social, and governance (ESG)/sustainability template websites. Source: EEI/POWER

Changes in the updated template may partially have been driven by the SEC’s 2021 announcements that it was contemplating regulations for ESG and sustainability disclosures, as well as cyber governance and reporting, and a reopening of a human capital management docket.

Two weeks before the SEC approved the proposed rule on climate risk disclosures, it notably proposed amendments to rules to enhance and standardize disclosures regarding cybersecurity risk management, strategy, governance, and incident reporting by public companies. The proposed amendments would require, among other things, current reporting about material cybersecurity incidents and periodic reporting to provide updates about previously reported cybersecurity incidents.

EEI, AGA Asked SEC for Sector-Specific Rule

While EEI did not directly comment on how the SEC’s proposal could affect its ESG template reporting, Richard McMahon, EEI’s senior vice president for Energy Delivery and Finance, told POWER on March 21 that the trade group is “thoroughly reviewing the SEC’s proposed rule, and we will remain engaged with the SEC as the rulemaking process moves forward.”

EEI and AGA had hoped that the SEC would adopt the May 2021 version of its template specifically for the power industry—as opposed to a “rules-based, one-size-fits-all approach.” In a June 2021 response to the SEC’s March 2021 request for information on climate change disclosures, EEI and AGA urged the commission to consider that the template was developed in a “transparent and inclusive” process that involved feedback from “policymakers and representatives of proxy advisory firms, rating agencies, ESG rating providers, non-governmental organizations (NGOs), including Ceres, the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD), and other key stakeholders.”

In that letter, the trade groups also notably cautioned the SEC against delegation of public company disclosure requirements to NGOs or private companies. “The processes for standards development by NGOs and private disclosure companies often are not transparent and do not adequately reflect the input of the impacted investors and issuer companies as critical stakeholders,” they noted.

Reflecting a broad concern about liability, the groups also advocated that “furnishing” the disclosures subject to a safe harbor—rather than filing the disclosures—would provide “the appropriate balance” of risks when providing new and evolving ESG disclosures. “We reemphasize that climate change data and disclosure are inherently uncertain—particularly scenario-based data and forward-looking models using long time horizons. Therefore, a safe harbor is necessary and would allow, as well as encourage, companies to provide more robust information without unnecessarily exposing them to liability as the models and scenarios change over time,” the groups wrote.

In addition, the groups supported specific metrics. For the electric power industry, suggested metrics included direct carbon emissions from company-owned generation and power that is purchased for delivery to and use by customers. For the natural gas sector, metrics included direct methane emissions as the most relevant climate-related data. One of the main reasons that EEI and AGA developed the template was that the existing disclosure standards and frameworks did not meet investor needs for industry-specific metrics for our sector based on investors’ feedback,” they noted.

A key goal for the template is to provide “a concise and consistent way that meets the needs of investors,” McMahon explained. “Our comprehensive ESG reporting tools support transparency and showcase the outstanding work our member companies are doing to benefit the customers and the communities we serve.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

The post SEC’s Landmark Climate Disclosure Rule Weighing on Power Sector appeared first on POWER Magazine.