Large-Scale Hydrogen Projects Take Shape as Technology Continues to Evolve

Credit to Author: Aaron Larson| Date: Mon, 02 May 2022 04:19:00 +0000

If hydrogen-based power technology and decarbonization schemes seem like a novelty to you, you may not be paying close enough attention to developments happening around the world. While some hydrogen pilot projects are still relatively small in scale, the size of undertakings is rapidly growing.

Hydrogen has been a trendy topic for several years now. Many people believe it could be the key to efforts to decarbonize the world’s energy supply. Yet, some people think it will take multiple decades before hydrogen truly makes an impact.

However, that line of thinking may be wrong. A great deal of money has been—and is being—spent on hydrogen technology today, and serious projects are getting done. The effects of these investments could be felt sooner rather than later.

The Promise of Green Hydrogen

Most hydrogen produced today comes from plants that use fossil fuels such as natural gas in the process. In fact, Worley, an engineering company headquartered in Australia that is currently implementing more than 120 hydrogen projects worldwide, claims less than 1% of current hydrogen production is low-carbon. However, the firm says pathways already exist for a hydrogen economy that can quickly and reliably slash emissions. Worley envisions a future with “inexhaustible” supplies of “green hydrogen” produced through electrolysis using solar and wind power.

Dr. Hans Dieter Hermes, vice president of Clean Hydrogen with Worley, suggested the cost curves for hydrogen could look very similar to those observed in the offshore wind industry over the past decade. As a guest on The POWER Podcast recently, Hermes said every offshore foundation was a pilot project 10 or 20 years ago and costs were very high. But nowadays, the offshore wind industry is very mature and costs have come down dramatically. “I expect that the same will happen with the hydrogen sector. We already see a very steep cost reduction,” he said.

To date, cost reductions have come through the integration of lessons learned from earlier projects and also through new developments that have been triggered by growing market demand. Because hydrogen shares similarities with the way oil and gas are processed and transported, some existing infrastructure is likely to be utilized to handle hydrogen, which should save on costs in the future. If Worley’s vision ultimately comes to fruition, the potential exists to reduce transportation emissions, revolutionize steel making, assist oil refineries in making green fuel, and provide feedstock for fertilizers. Hydrogen could ultimately be the savior for industries that must decarbonize including the power industry.

A Mega-Scale Hydrogen Project

Perhaps the most ambitious hydrogen project that Worley is involved in is a low-carbon fuels project being led by the international consortium Green Energy Oman (GEO). The GEO consortium comprises OQ, the Sultanate of Oman’s global integrated energy company; InterContinental Energy, a leading dedicated green-fuels developer; and EnerTech, a Kuwait government–backed clean energy investor and developer. Worley’s role in the project is to provide “concept feasibility study services to develop and challenge GEO’s defined green hydrogen energy project.” This includes optimizing about 25 GW of wind and solar generation, transforming this renewable energy through electrolysis into green hydrogen, as well as the production, storage, and export of green ammonia.

In addition to defining the project components, Worley’s study is expected to “identify opportunities to enhance in-country value delivered from the expected 10-year project implementation period.” The project aims to produce more than 1.8 million tons of low-carbon green hydrogen annually, which could produce up to 10 million tons of green ammonia.

The GEO consortium has been conducting wind and solar monitoring analysis in Al Wusta Governorate in central Oman since 2019. The region benefits from very high and stable levels of both solar and wind energy, which exhibit the optimal diurnal profile of strong wind at night and reliable sun during the day. The project is also located near the coast, which allows adequate seawater intake for electrolysis and suitable infrastructure for shipping purposes (Figure 1). OQ said given the site’s strategic location between Europe and Asia, the project is well-positioned “to offer a secure and reliable supply of green fuels globally at a highly competitive price.”

|

1. The Sultanate of Oman’s global integrated energy company OQ has been collaborating for more than four years on a mega-scale project that will include 25 GW of renewable solar and wind power capacity, and produce millions of tons of zero-carbon green hydrogen per year. Much of the hydrogen is expected to be converted into green ammonia for international export. Courtesy: OQ |

Oil and gas (O&G) supermajor BP is also a partner with Oman in the project. The company signed an agreement in January with the Ministry of Energy and Minerals, which will have the company capture and evaluate solar and wind data from 8,000 square kilometers (roughly 2,000,000 acres) of land, an area about two and a half times the size of Rhode Island. The evaluation will support the government of Oman in approving future developments of renewable energy hubs at suitable locations within this area to take advantage of these resources.

Diversifying Operations

Other O&G supermajors also see hydrogen as an opportunity. Last summer, Shell started up Europe’s largest PEM (polymer electrolyte membrane) green hydrogen electrolyzer at its Energy and Chemicals Park Rheinland site near Cologne, Germany. PEM electrolyzers are more compact than a conventional alkaline electrolyzer. They are also well-suited to working with renewable energy sources because they can operate dynamically using varying loads of electricity.

While minuscule compared to the size of the GEO project, the 10-MW Rheinland electrolyser will use renewable electricity to produce up to 1,300 tonnes of green hydrogen a year. This will initially be used to produce fuels with lower carbon intensity. Shell said the green hydrogen will also be used to help decarbonize other industries.

A European consortium consisting of Shell, ITM Power, research organization SINTEF, and consultants Sphera and Element Energy backed the project. The electrolyzer was manufactured by ITM Power in Sheffield, UK, and includes parts made in Italy, Sweden, Spain, and Germany. Plans are already underway to expand electrolyzer capacity at the site to 100 MW. In the future, Shell also intends to produce sustainable aviation fuel using renewable power and biomass. A plant for liquefied renewable natural gas (bio-LNG) is also in development.

Shell is involved in a lengthy list of other projects around the world too. In late January, the company began operation of a 20-MW power-to-hydrogen electrolyzer in Zhangjiakou, Hebei Province, China. The project is part of a joint venture between Shell China and Zhangjiakou City Transport Construction Investment Holding Group Co. Ltd. The electrolyzer and hydrogen refueling stations in Zhangjiakou are Phase 1 of the joint venture. The companies have plans to scale up to 60 MW in the next two years in Phase 2.

The project—Shell’s first commercial hydrogen development project in China—was completed in only 13 months. It utilizes onshore wind power and was initially used to supply green hydrogen to fuel a fleet of more than 600 fuel cell vehicles at the Zhangjiakou competition zone during the Winter Olympic Games. Now, the hydrogen is being used for public and commercial transport in the Beijing-Tianjin-Hebei region, helping to decarbonize its mobility sector.

Innovative Hydrogen Fuel Cell Power Plant

Hanwha Energy, a comprehensive energy-solutions company based in Seoul, South Korea, has been on the hydrogen bandwagon for a while. In 2020, the company commissioned the largest industrial hydrogen-fuel-cell power plant in the world, which was also the first to use only hydrogen recycled from petrochemical manufacturing. The 50-MW plant is located at the Daesan Industrial Complex in Seosan, South Korea (Figure 2).

|

2. With a 50-MW capacity, the power system built at the Daesan Industrial Complex in Seosan, South Korea, is the world’s largest industrial hydrogen-fuel-cell power plant and the first to use only hydrogen recycled from petrochemical manufacturing. Courtesy: Hanwha Energy |

To facilitate completion of the project, Hanwha Energy partnered with Korea East-West Power and Doosan Corp. to establish Daesan Green Energy, a special-purpose company. Hanwha Energy is the largest shareholder and responsible for the power plant’s day-to-day operations. Korea East-West Power purchases the renewable energy certificates produced by the hydrogen-fuel-cell power plant, while Doosan Corp. supplies and maintains the hydrogen fuel cells.

The hydrogen used in the plant is supplied by the Hanwha Total Petrochemical plant located within the same Daesan Industrial Complex. Hanwha Total Petrochemical pumps the recycled hydrogen into the power plant via underground pipes and feeds it directly into the fuel cells. Electricity is then generated by an electrochemical reaction between hydrogen and oxygen. Pure water is the only byproduct of the fuel cells.

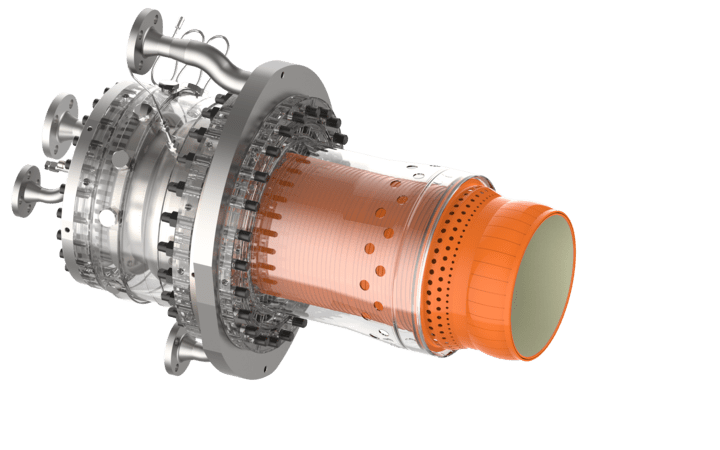

Advanced Gas Turbine Combustion TechnologyAnother example of Hanwha’s interest in the hydrogen economy is its acquisition in July 2021 of PSM, a comprehensive aftermarket gas turbine services provider based in Jupiter, Florida, and PSM’s sister company Ansaldo Thomassen (now Thomassen Energy), which has headquarters in the Netherlands. Hanwha found the businesses attractive in part because PSM and Thomassen have developed an innovative advanced combustion system platform called the FlameSheet that allows greater fuel flexibility in many gas turbines, including the ability to burn higher percentages of hydrogen. The combustion system also allows greater turndown, lower NOx emissions, and increased ramping capability. Furthermore, the FlameSheet combustion system is said to handle the wide range of shale gas compositions better than original equipment manufacturer (OEM) designs. “We originally began designing this innovative clean-sheet combustor system in 2002 based on a rigorous ‘Voice of the Customer’ exercise with our parent company at that time, Calpine. They demanded an alternative to the designs being offered by the OEMs, which weren’t meeting the needs of the market. Working hand in hand with Calpine, the design actually successfully tested in 2005 on a Siemens-Westinghouse 501FD2 in Nevada. Due to a number of market and ownership changes, the FlameSheet wasn’t introduced into actual commercial operation until 2015,” Katie Koch, global product manager for PSM, told POWER. “It’s now operating successfully on several 7F and 501F units—10 units now—and we have nine more under contract, including for our first 7EA unit,” she said. PSM says the FlameSheet combustion system platform is designed as a straightforward retrofit to vintage OEM technology operators want to replace (Figure 4). The system utilizes the existing turbine’s fuel skid, fuel delivery manifolding, and gas turbine controller.  “The design utilizes four fuel circuits in a dual-staged configuration, mixing the fuel and air via unique geometric features, and then stabilizes the high-velocity flame via a trapped vortex mechanism, rather than a low-velocity, swirl-stabilized one. This allows for much better mixedness control, resulting in lower NOx emissions, and the flow velocity makes it particularly good at co-firing hydrogen and natural gas without the concern about flame flashback, which can cause significant damage to the combustion hardware,” the company told POWER. Taken together, this operational design approach is said to offer tremendous hydrogen-burning capability (up to 60% by volume without the use of flame temperature diluents such as water injection), limits negative impacts to the operator’s air permit, and requires no modifications to the unit’s heat recovery steam generator (HRSG) or selective catalytic reduction (SCR) system. “Our technology roadmap for our FlameSheet platform has us achieving 100% hydrogen in the very near future, but most importantly, allowing 100% natural gas fuel if required or any variable blend of hydrogen and natural gas for that matter. Having this inherent fuel flexibility is a crucial element of our offering strategy and will give our customers the strategic flexibility to begin their gas turbine decarbonization journey now, as significant volumes of blue, green, and pink hydrogen become available. Our view is that these assets can be positioned as the dispatchable, responsive firming capacity within the growing but intermittent renewable power generation asset landscape,” Jeff Benoit, vice president of Clean Energy Solutions for PSM, told POWER. “The FlameSheet combustor system replaces the combustion components up to the transition piece of the current OEM design. The head-end components, replacing the fuel nozzles consist of a pilot cartridge, pilot injector, spool case, dome, and main injector, and are identical for 7EA, 7FA, and 501F units,” Koch explained. “The liner and flow sleeve are also redesigned and specific to either the 501F or 7E/7F units. This cross-platform design has the advantage of shared inventory for users with large fleets and the concept is applied to many of PSM’s designs,” she said. Recently, PSM completed additional testing on the latest generation of FlameSheet technology in a high-pressure rig in Germany. “We have demonstrated in high-pressure rig testing multiple times with our FlameSheet that we can safely achieve 60% hydrogen by volume at low NOx levels—sub 9 ppm NOx or lower—without diluents,” Koch said. Hanwha is quickly incorporating PSM’s technology within its portfolio of low-carbon ventures. Alongside the hydrogen fuel cells project noted above, Hanwha will be relocating and retrofitting a 7EA unit installed with the latest generation of FlameSheet at the nearby Korea Western Power Co. power plant targeting 50% hydrogen by volume in the first phase, expected to be completed in 2023. In addition to PSM, Hanwha’s low-carbon investment portfolio includes the companies 174 Power Global, which focuses on solar project development and energy storage, and Q-Cells, which produces solar panels. Among projects in 174 Power Global’s queue is a green hydrogen facility its developing at the company’s Atlas Energy Park in Arizona. When fully commissioned, the site is expected to produce up to 8 metric tons of green hydrogen daily using a fleet of solar panels and electolyzers. |

100% Hydrogen–Fueled Reciprocating Engines

Hyosung Heavy Industries announced in November 2021 that it would undertake a project that will also run on hydrogen produced as a byproduct at a chemical plant. In this case, however, the hydrogen will be used to fuel an INNIO Jenbacher engine. The company says the pilot hydrogen power plant, which will be built at the Hyosung Chemical Yongyeon Plant in Ulsan, South Korea, will be “the second power plant in the 1-MW range that can be fueled with 100% hydrogen.”

The first was completed in 2020. INNIO and HanseWerk Natur partnered on that project, which converted a combined heat and power (CHP) plant in the Othmarschen area of Hamburg, Germany, and involved field testing using variable hydrogen and natural gas mixtures up to 100% hydrogen. The converted CHP plant provides local heating for 30 residential buildings, a sports center, a daycare center, and the Othmarschen Park leisure complex. The electricity generated by the plant feeds electric vehicle charging points in Othmarschen’s multi-level parking garage, as well as to the local power grid. INNIO said that projects like these are “a key milestone on the path toward climate neutrality since green hydrogen is an important part of the solution.”

“A particularly attractive aspect of our gas engine technology is that existing natural gas engines can also be converted to run on hydrogen. This offers operators security of investment, with the added benefit that the existing infrastructure can not only be utilized in the longer term, but also deployed in a way that is environmentally sound,” Carlos Lange, president and CEO of INNIO, said in a statement when field testing began on the project in late 2020.

—Aaron Larson is POWER’s executive editor.

The post Large-Scale Hydrogen Projects Take Shape as Technology Continues to Evolve appeared first on POWER Magazine.