Four Forces Shaping U.S. Utilities in 2023

Credit to Author: Contributed Content| Date: Thu, 08 Dec 2022 13:43:48 +0000

In 2023, U.S. utilities have a multipronged ambition to realize: how to provide customers with reliable, affordable, and sustainable energy, and safe water. However, increased pressure around decarbonization and the adoption of cleaner energy sources, electrification, and related infrastructure needs, and customer-driven disruption will make this energy trilemma even more difficult to balance.

Management at many utilities feels a sense of urgency around these challenges and the related energy transition, but change won’t happen overnight. Capital only goes so far; and keeping costs low to avoid rate hikes in a down economy is critical. At the same time, reliability underpins the utility’s license to operate and can’t be ignored. Ensuring an equitable transition will take time and a diverse energy mix. As the market evolves, new players—with new capabilities—will continue entering the playing field, adding even more complexity.

Utilities must determine today how and where they will play—both in the short term and long term—and focus their investments and resources on four no-regrets actions to enable that strategy.

Reimagine the Energy Customer Dynamic

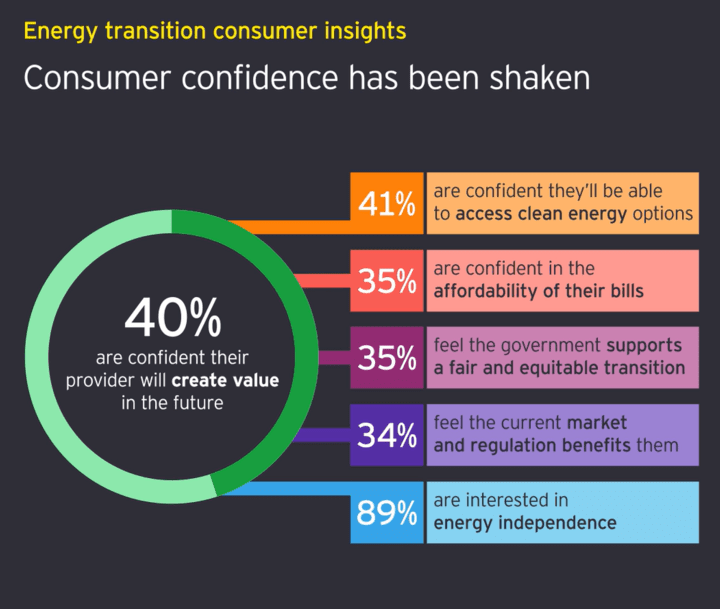

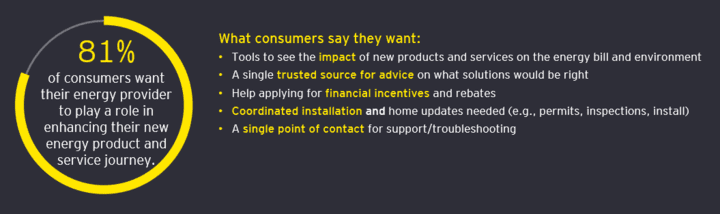

The EY Energy transition consumer insights report, which surveyed 70,000 consumers across 18 regions over the last two years, found that consumers are not just ready for change—they are leading the way. Rising prices and market disruption have fueled their interest in clean energy and energy efficiency, and helped accelerate adoption of new solutions like electric vehicles and rooftop solar.

At the same time, volatility has taken a toll on consumer confidence in an industry that for years has been taken for granted. Since 2021, EY research found more than 80 energy providers have gone out of business in competitive markets. Further, newsworthy disruptions in service due to adverse weather events—like the numerous wildfires, heat waves, freezes, and storms across the U.S. recently—only add to consumers’ perceptions that they might not be able to count on their local utility.

To overcome these challenges and build for a new energy future, transforming the customer experience is essential to survival. Leading utilities are harnessing the data that technology can provide for a more agile response to changes in customer behavior and to enable a more seamless customer experience.

Balance Decarbonization Ambitions with Grid Resiliency

The foundation of any utility is providing reliable service, be it keeping the lights on or safely providing gas or water. That’s increasingly difficult in a world where service disruptions due to weather and increasing electrification make resiliency and reliability a major challenge.

Undergrounding transmission or distribution infrastructure, interconnecting decentralized renewable resources, moving back-office systems to the cloud, and transitioning fleets to electric vehicles are just a few capital-intensive, but critical, projects to help utility companies move forward. These needs are also competing with dramatically higher commodity costs that put pressure on rates.

An additional area of pressure impacting grid investments is related to energy equity among stakeholders—ensuring that improvements to the grid benefit all consumers and that lower-income households have access to affordable energy and green options. Utilities must be smart with their capital spend, first ensuring that they are investing properly in secure, stable infrastructure, while maximizing operational efficiency and reducing costs to keep rates as low as possible for the benefit of consumers.

Electric utilities must also appropriately manage the types of power they supply. The shift to renewables must be done in a manner that protects prices to benefit consumers. Balance is key. In some cases, it may make sense to continue in the near term with traditional sources of power to ensure that affordable energy is accessible to all.

Water utilities are not immune to challenges. Addressing aging water and wastewater infrastructure is critical, and many utilities face looming supply shortages due to population growth and a hotter, drier climate. Natural gas utilities must cope with many of the same issues as their electric power counterparts.

Enable Transformation with Technology

Recognizing these diverse challenges, some utilities are moving quickly to leverage technology—both digital capabilities and data—to propel them forward. A recent EY survey conducted across a segment of the utility industry shows that power and utility executives see the value in data as an asset, recognizing that it can support innovation, efficiency, and predictive maintenance, as well as help identify both short- and long-term trends they can use to plan for alternate scenarios—vital in resiliency planning.

However, many utilities are at the nascent stages of establishing a modern data plan. They aren’t comfortable with the vast amounts of data that digital technology makes possible and how it should be used. They lack the ability to gain a clear picture of consumer behavior or how assets will perform. It’s an area of significant opportunity for utilities to improve upon, which will be necessary in the coming year and beyond due to new regulations around climate disclosures that will require increased investments to enable accurate and transparent environmental, social, and governance reporting.

Furthermore, data security and cyber attacks are top of mind for utility management teams. The need for high-quality data—and the security resources to protect it—will only become more pressing at all public utilities.

Create the Business of the Future

The number of challenges facing the industry—combined with valuable, future-oriented opportunities—can be overwhelming. It’s impossible for a single utility to be all things to all stakeholders, and leaders must choose a path that best suits their organization’s unique strengths and market position.

The last half of 2022 saw an uptick in mergers and acquisitions (M&A) volume across the sector, with 21 deals worth $3.72 billion in the renewables segment alone for the third quarter, per EY Power and Utilities Transactions and Trends. Most of that M&A activity was centered on investments in solar and wind portfolios, but renewable natural gas is also emerging as a core investment area. We expect to see both corporate and financial investors continuing to aggressively evaluate renewable energy opportunities in 2023.

The Inflation Reduction Act (IRA) of 2022, which provides significant incentives for investing in renewable energy and clean technologies, is also spurring interest in power and utilities, and is almost certain to drive investment demand for renewable infrastructure and cleantech. The law extends tax credits with incentives for wind, solar, carbon sequestration, clean hydrogen, nuclear, and other technologies. The IRA targets $369 billion of investments in energy and climate over the next decade, and is expected to drive a cumulative capital investment of more than $4.1 trillion in the U.S. energy supply infrastructure.

Utilities have a variety of options for participating in an evolving new marketplace: They can invest in the build-out of renewable assets and infrastructure (including electric vehicles), utilizing incentives from the IRA; they can invest in developing the software and technology needed to manage these assets; or they can build out capabilities in the related services required to support these investments.

In short, there is a wide range of viable business models available, and utilities have the benefit of an embedded base of assets, capabilities, and customers. Utilities can use their expertise and built-in knowledge to get a jump start on emerging opportunities, or partner with new players to take advantage of unique skill sets their organization doesn’t possess. To move forward successfully, utilities must develop a detailed point of view on what their customers want, understand and incorporate what regulators expect, determine and progress a strategy on what the organization and its offerings will look like in the short and long term, and build out the asset and capability base to support those strategies.

—Trey Thornton is EY Americas Power & Utilities Leader, and Jeff Miller is EY Americas Power & Utilities Strategy Leader. The views reflected in this article are the views of the authors and do not necessarily reflect the views of Ernst & Young LLP or other members of the global EY organization.

The post Four Forces Shaping U.S. Utilities in 2023 appeared first on POWER Magazine.