NERC: Accelerated Coal and Nuclear Retirements Pose Limited Reliability Risks

Credit to Author: Sonal Patel| Date: Thu, 20 Dec 2018 14:37:32 +0000

The accelerated retirement of coal-fired and nuclear generation by 2022 could adversely affect reliability in four regions, including in the east and over a swathe of the central U.S., the North American Electric Reliability Corp. (NERC) warned as it released findings from a “stress-test” scenario.

But the entity tasked with ensuring reliability and security of the North American bulk power system (BPS) also noted six of 10 assessment areas—which cover PJM, New England, MISO, the Electric Reliability Council of Texas (ERCOT), and the Western coast—would have enough generation capacity to maintain peak demand, even if they see high levels of generator retirements over the next five years.

A “Stress-Test” Scenario

The findings stem from NERC’s Dec. 18–released “Generation Retirement Scenario,” which the entity evaluated because, it said, the retirement of traditional baseload generators and their rapid replacement with natural gas–fired, wind, and solar generation “is changing the characteristics of the BPS and introducing new considerations for reliability planning.”

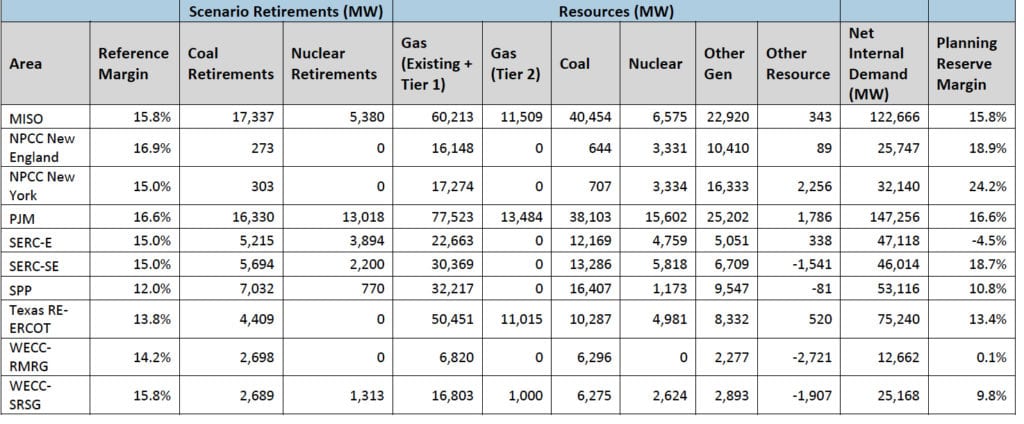

The so-called “stress-test” scenario essentially assumes that areas where coal and nuclear currently make up a large share of resource levels will see accelerated retirements so that by 2022, they will lose 30% of their coal capacity and 45% of their nuclear capacity. That capacity will be replaced by prospective new generation resources reported in NERC’s “2017 Long-Term Retirement Assessment” (2017 LTRA)—mainly comprising natural gas, wind, and solar.

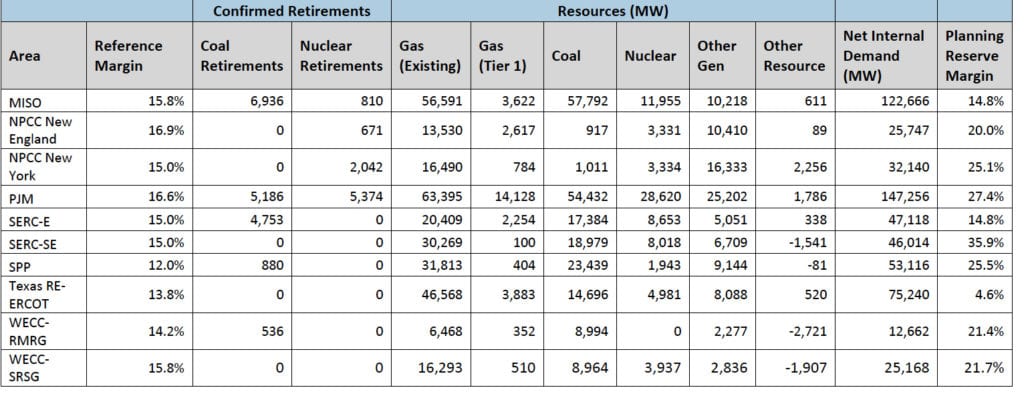

The scenario compared a reference case based on the 2017 LTRA’s findings, which takes into account 27 GW of confirmed generation retirements through 2022—18 GW of coal and nearly 9 GW of nuclear. Notably, the stress-test scenario uses a U.S. Energy Information Administration sensitivity case to identify potential coal and nuclear retirement capacity through 2025 and then accelerates them to 2022. The scenario retires 91 GW—62 GW of coal and 29 GW of nuclear—in addition to confirmed projections from the 2017 LTRA.

Detailed results of resource adequacy analysis by 2022 (reference case, based on 2017 long-term reliability assessment projections). Courtesy: NERC

Detailed results of resource adequacy analysis in the generation retirement scenario by 2022. Courtesy: NERC

But even under these conditions, six of 10 areas assessed would have sufficient resource capacity (defined as existing and Tier 1 and 2 generation from the interconnection queue) to maintain planning reserve margins in 2022. Reserve margin deficiencies do not result in PJM, MISO, ERCOT, NYISO, ISO-NE, and SERC Southeast. However, SERC East, SPP, WECC-RMRG, and WECC-SRSG “could anticipate resource adequacy issues resulting from generation retirements,” the report said.

Modeling Reliability Risks Amid Uncertainties

In a phone briefing with reporters on Dec. 18, John Moura, director of NERC’s Reliability Assessment division stressed repeatedly that the study’s sole objective is to “identify risk,” and is not intended to be a “predictive forecast.” However, the report notes that the scenario, which takes into account several “extreme event” scenarios, including a Polar Vortex-type cold snap, “may be unparalleled,” as “it provides insight into boundary conditions and the nature of the changing resource mix.” Specifically, the report notes, various factors are currently affecting generation resource additions and retirements, including “wholesale electricity market response to generator retirements, government incentives, and technology development.”

In past reliability assessments, NERC has also highlighted “several emerging reliability issues” related to the changing resource mix. Along with fuel supply and delivery vulnerabilities posed by a high dependence on natural gas generation, it has pointed to increasing amounts of distributed energy resources, which are changing how the distribution system interacts with the BPS—and “transforms the distribution system into an active source for energy and some [essential reliability services (ERSs)].”

NERC’s Message to BPS Planners

According to Moura, the stress-test study calls attention to a wide range of potential issues that BPS planners should address to maintain reliability. On a regional (RTO/ISO) scale, he said, it would mean considering significant amounts of replacement generation capacity, which could create “the need for expediting development of generation resources in interconnection queues.” If, however, sufficient replacement resources are unavailable to make up for planned retirements, actions may be needed to ensure resource adequacy. These actions could include “delaying planned retirements, deployment of additional demand response or other demand-side resources, and/or larger-scale electricity storage.”

“The first finding, really, is that the scenario affirms that with risk-informed planning, regulatory and market based tools can ensure continuous supply adequacy of the BPS,” he said. Integrated resource plans that take gas and electric generation systems as well as policies into account “create a 10-year window that provides a certain level of certainty,” he said.

On the competitive market side, longer-term certainty is diminished owing to economics and cost concerns. Still, Moura said: “These market systems are evolving. We highlight in our assessment that there are really great new initiatives underway to increase the performance of systems, of generation under extreme conditions.” Among tools that have functioned “very well”—but weren’t tested in the stress-test scenario—is the reliability must-run (RMR) mechanism, which is a stop-gap measure deployed under agreement with a generator when an ISO or RTO determines a unit planning to retire is needed for reliability. “From a risk standpoint, we want to make sure RMR and ensuring the right resources are in place and aren’t forcibly retired.”

Moura also urged planners to consider necessary transmission upgrades or reinforcements as well as new gas infrastructure. “When you’re going to 60% to 70% natural gas, a lot more needs to be developed from an infrastructure perspective.”

The Grid Reliability Debate Grows More Heated

NERC’s findings in the special reliability assessment are especially important in light of increased political scuffling as it relates to grid reliability. The Senate on Dec. 6 narrowly confirmed Bernard McNamee to a seat on the five-member Federal Energy Regulatory Commission (FERC) with a 50–49 party-line vote. McNamee’s nomination to FERC was questioned after a video, recorded in February, showed him criticizing renewable energy and favoring fossil fuels.

On Dec. 18, environmental groups the Natural Resources Defense Council, the Sierra Club, and the Union of Concerned Scientists, filed a motion with FERC calling for McNamee to recuse himself from RM18-1 and AD18-17, dockets that FERC opened after it slapped down the Department of Energy’s (DOE) September 2017 “Grid Resiliency Pricing Rule.” The proposed rule directed FERC, an independent entity under the DOE, to require that grid operators establish reasonable rates for power plants that show “reliability and resiliency attributes.” The DOE suggests that regulatory and economic factors have prompted the premature retirement of “fuel-secure” plants—which include nuclear and coal, but also oil-fired and dual-fuel units with adequate storage—at the “expense of fuel security and resilience.”

On Dec. 19, Amy Farrell, senior vice president for Government and Public Affairs at the American Wind Energy Association (AWEA) told POWER that NERC’s findings add to “the strong body of evidence confirming no grid reliability emergency exists.” She added: “While their extreme ‘stress-test scenario’ is an interesting academic exercise, it does not suggest a need for out-of-market intervention or modification to existing planning tools.” Farrell suggested a continuation of a risk-informed and market-based planning approach, combined with NERC’s recommended transmission investments, will best deliver “affordable, reliable power to America’s energy consumers and create a greater market for wind.”

Meanwhile, Michelle Bloodworth, president and CEO of the American Coalition of Clean Coal Electricity (ACCCE)—an organization that represents the nation’s coal generation fleet—on Dec. 19 said that the NERC special reliability assessment highlighted “concerns about the reliability and resilience of the grid if coal retirements accelerate.” Bloodworth said her group believes that “policies should be put in place to prevent more retirements. In addition, valuing fuel security is important to preventing retirements and protecting electricity consumers.”

Bloodworth also pointed to NERC’s recommendation that new transmission and fuel infrastructure will be needed if retirements continue. “[T]here are substantial hidden costs associated with continued retirements that are rarely quantified,” he said. “We urge FERC, grid operators and public utility commissioners to not only acknowledge these hidden costs but to quantify them. We believe these costs should be an explicit consideration in retirement decisions.”

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)

The post NERC: Accelerated Coal and Nuclear Retirements Pose Limited Reliability Risks appeared first on POWER Magazine.