Insights Into Siemens’ Stunning Gas and Power, Renewables Shakeup

Credit to Author: Sonal Patel| Date: Mon, 13 May 2019 03:05:05 +0000

In the days following its May 7 announcement that it will spin off its Gas and Power business, Siemens has fleshed out how and when the carveout will occur, laid out its reasons for lumping its energy businesses together, and put forth a market case for why a business separation may be a “win-win” situation for shareholders and employees.

The news has stunned many in the power sector, where Siemens has clenched a formidable presence since Werner von Siemens discovered the dynamo-electric principle in 1866. But senior company officials noted the decision to spinoff its power, renewables, oil and gas, and transmission businesses into a new company has been building for some time.

The move essentially seeks to satisfy demands from investors who are increasingly favoring simplified, pure-play companies, which have better share prices and sales growth, over conglomerates. Activist investors have prompted similar shakeups at Siemens’ rivals, like ABB, which recently offloaded a major stake of its Power Grids business to Hitachi, and GE, which has reshaped its power business through a series of divestments and reshuffling.

It would leave Siemens with a smaller basket of specialized industries with a digital core—though the company is still planning to absorb tens of thousands of new employees. The gas and power carveout, which won’t be completed until 2020, is meanwhile envisioned as a sprawling collection of businesses with hefty stakes along the full energy value chain. How it will fare within a highly fluid and competitive market remains unclear.

An Energetic Unbundling

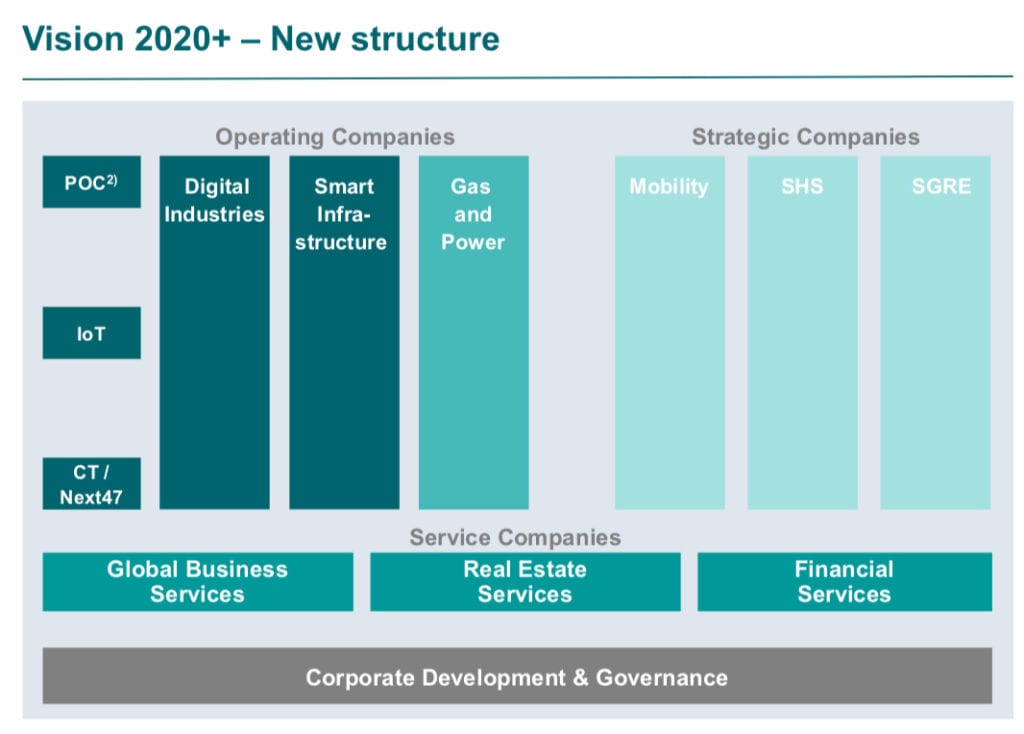

According to Joe Kaeser, president and CEO of Siemens AG, the global technology powerhouse that today has headquarters in both Berlin and Munich, efforts to unbundle the energy business are rooted in the company’s Vision 2020+ strategy. Siemens unveiled the strategy in August 2018 to concertedly boost the group’s profitability by making its structure leaner. Completed on April 1, it combines five of the company’s industrial divisions into three operating companies. But after implementing the strategy, Siemens “decided that simply sitting back and waiting to see what would happen next wasn’t an option for us,” Kaeser told reporters on May 7.

It was vital to Siemens’ future to ask: “How can we strengthen important businesses and get them valuable perspective and simultaneously mitigate risks for Siemens, optimize return on capital employed, and offer employees the attractive future-oriented options?” he said.

“We wanted to have a stakeholder optimization taking place, which would then overall truly contribute in an all-around win-win situation.”

Vision 2020+ envisioned a new structure for Siemens, a sprawling conglomerate that has businesses spanning trains to turbines. Courtesy: Siemens, May 2019.

Overhauling the Power Business

First, Siemens moved to consolidate its renewable energy business, Siemens Gamesa Renewable Energy (SGRE), a company created in 2017 with the merger of Siemens Wind Power and Spanish firm Gamesa, in which Siemens now holds a 59% stake. “We believe we have created one of the industry’s top suppliers, and even if it was difficult in the beginning, I believe today it truly is one of the leading and trailblazing companies within the industry,” Kaeser said.

SGRE’s numbers “truly are not that bad,” Kaeser acknowledged. On the morning before Siemens announced the spinoff, SGRE posted its financial results for the first half of fiscal year (FY) 2019 (October to March), noting it increased net profits to €67 million ($75.26 million)—from €0 in the same period last year. It also closed the period with a record order backlog of €23.6 billion ($26.5 billion). In the first half, revenue soared 6% to €4.7 billion ($5.22 billion), owing largely to substantial growth in the offshore and service businesses, even though it saw a decline in onshore businesses on a regional basis. During the second quarter, SGRE also marked significant achievements, including becoming the world’s first wind turbine manufacturer to attain an investment grade rating (S&P gave it a BBB– long-term credit rating with a positive outlook, while Moody’s gave it a Baa3 stable outlook). “Of course, the shares can grow 20, 30, 40%, and definitely [exceed] market expectations, but we as the main shareholders are definitely happy with the numbers and the management,” Kaeser said.

Second, Siemens wanted to “stabilize” its conventional power generation, and oil and gas activities. Market volatility in conventional coal and energy production have made it more “economy-based,” and a revitalization was necessary “to move in the right direction,” Kaeser said.

Third, and perhaps most significantly, was Siemens efforts to combine its power generation activities with power transmission. “This complexity of the renewable energies and the decentralization and supplying all of this, of course, goes into the complexity of this third point, and that’s why it was so very important to combine all of this,” he said.

The margin of the power generation business is exemplary of why that move was important, Kaeser noted. In the first half of FY2019, Siemens recorded a 9% increase in orders for its power and gas business compared to the same period in 2018 (6,805 compared to 6,236)—but it suffered a 7% revenue decline. Revenues in the first half of FY2019 stood at €5.7 billion ($6.4 billion) versus €6.1 billion ($6.9 billion) in the same period in FY2018.

A New Company with More Potential

Lumping the businesses together would give the new company more of a fighting chance, Kaeser suggested on Tuesday. “By bringing all these elements together, we are building a focus, an attractive company with a range of offering that is unique in this industry,” he said.

The new company—which Siemens calls “NewCo” in official documents—will have “complete independence and entrepreneurial freedom when its ownership is transferred to shareholders through the carveout and subsequent public listing,” which is likely by September 2020, Kaeser said.

As Lisa Davis, CEO of Siemens’ Gas and Power, told reporters on May 7, the new company will likely be headquartered in Germany, but it will depend on “how we really choose to operate the new company.” The company’s customers are global, she noted. “And so we’ll want to be based where our customers are as well.”

However, the spinoff—a “major step” for Siemens—will be rolled out “very fast,” Kaeser said, noting employee representatives and the supervisory board agreed a quick, clear implementation would benefit both customers and employees. Siemens has also notified the European Union’s Economic Policy Committee—a body that seeks to uphold regional growth and competitiveness.

For now, the carveout is to be completed by April 2020. In June 2020, Siemens is planning an “extraordinary general meeting”—one not held on a regular basis—for shareholders. “With the approval of shareholders, we intend to list the new company on the stock exchange in September 2020,” Kaeser said.

Selling Solid Success in a Fluid Market

Despite challenges that lie in the path of the carveout’s finalization, along with rapid changes that are transforming the industry, Siemens claims it is confident about its decision. “We’re already convinced [the new company] will be a success,” Kaeser said.

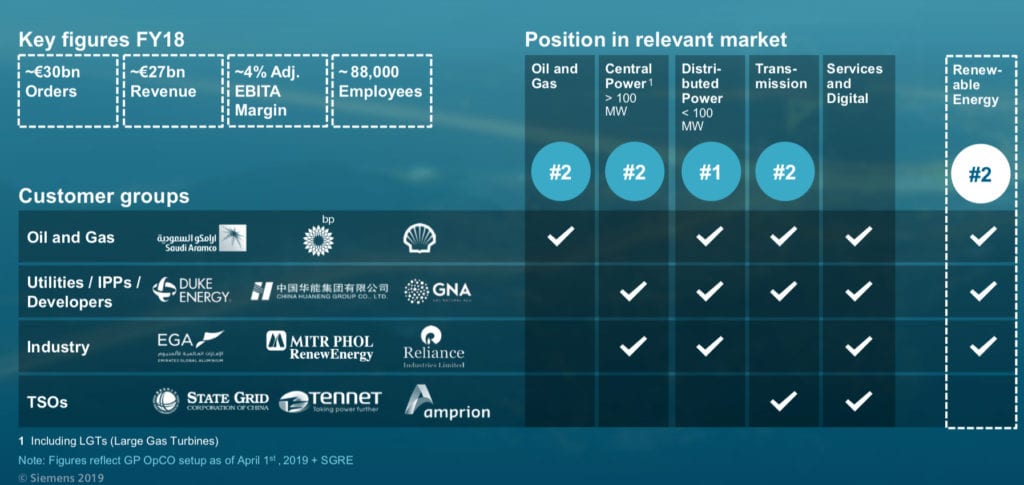

One reason is that “focus creates growth,” he said, noting Siemens projects that electrification and electric mobility will continue to grow in importance. NewCo would also emerge as a standalone with around €30 billion in orders, €70 billion in an order backlog, €27 billion in revenue, and a workforce of 88,000 employees. About 35% of its revenue would come from conventional generation—including Siemens’ lucrative gas turbine businesses—33% from SGRE, 21% from its grid offerings and services, and 11% from oil and gas.

The spun-off company—called “NewCo” for now—will comprise Siemens’ conventional generation, SGRE, grid, and oil and gas businesses. Courtesy: Siemens, May 2019.

As a pure player, meanwhile, it would “no longer have to compete with resources with higher margin businesses at Siemens, like digital industries and smart infrastructure,” Kaeser noted. And because it would be independent, NewCo’s business performance would become “more transparent and directly measurable,” he said. The new company will also be able to adapt to changing conditions that characterize power, oil and gas, and transmission sectors today. “The portfolio … is unique worldwide,” Kaeser noted. “It ranges from power generation through efficient gas-fired turbines and wind turbines to offerings to our customers from the oil and gas industry, and extends all the way to high-voltage transmission grid solutions, and much more.”

Finally, though NewCo will be independent from Siemens, it will, in the beginning at least, still have Siemens as a “strong investor.” Kaeser said Siemens intends to hold “at least a blocking minority of 25% plus one chair, but still less than 50%.” He added: “We haven’t hashed out exactly the final number, but I would be truly surprised if we still made a statement with our initial involvement.” NewCo, however, will still have access to Siemens’ digital platforms and financial and other services.

Kaeser also emphasized the new company’s value creation attributes. “It’s clear the spinoff and its listing will create value for all stakeholders, but it also creates optionality because … shareholders of the old Siemens … would be able to divest or keep their stocks.” Siemens anticipates that from 2019 to 2023, NewCo could see a growth rate of 2% to 3%, as well as an EBITDA (earnings before interest, tax, depreciation, and amortization) margin of 8% to 12%, he suggested. “Now, those are ambitious targets—we’re aware of that—but they’re definitely achievable,” he said.

Fostering a Digital Core

The carveout, meanwhile, will allow Siemens to concentrate its resources and place a sharper focus on its new “industrial core” businesses. The spinoff would leave Siemens’ Digital Industries (DI) and Smart Infrastructure (SI) divisions as its core, Kaeser said, though Siemens will also continue to foster its majority stake in Siemens Healthineers, which provides medical and health products and services, as well as Siemens Mobility, which provides smart mobility solutions for rail and road transport.

Notably, those efforts will require the “largest workforce increase by 2023” in an assortment of business-related areas such as research and development, engineering, production, and sales, Kaeser said. Siemens, for example, will add 12,000 new employees to DI and 6,000 new hires in SI. Last August, Kaeser noted, Siemens announced it would hire 10,000 employees into its new Internet of Things (IoT) unit along with goals to generate revenues of €1 billion. Siemens has already hired 7,500 people to date, he said.

Meanwhile, the overall efficiency-boosting factors ordained by Vision 2020+ are designed to translate into crucial financial gains, Kaeser noted. “We expect to improve our cost structure by a total €2.2 billion by 2023—and this figure includes the efficiency program in gas and power … which we presented a few months ago for the amount of €500 million,” he said. “We want to reach €1.5 billion by 2021.”

However, he pointed out that Siemens expects “some outlays” for restructuring of gas and power, expenses it cannot yet quantify. “We want to generate that new power company, we want to give it a proper structure. That’s our first step. At our very next occasion—I think in early July—we’ll be able to give you more details about how these efficiency increases can be achieved, which are based upon the new structure applicable as of April 1.”

The Future of Gas and Power

NewCo will be headed—at least until her planned departure in October 2021—by Davis, an American businesswoman who has served as a member of Siemens’ managing board as well as CEO of Siemens’ Gas and Power division for the past five years.

As Davis told reporters on Tuesday, from her view, implementation of the Vision 2020+ strategy on April 1 had already created the new gas and power standalone. Operations are already underway at “the only company in the world that leads along the entire energy value chain … from oil and gas, to power generation—both central and distributed—and also transmission,” she said. From her view, on May 7, the entity effectively absorbed Siemens’ majority SGRE stake.

However, in contrast to Kaeser’s call for simplification for Siemens, Davis lauded the new company’s sprawling scope, a characteristic that she said makes it unique when compared to major oil and gas firms, utilities and independent power producers (IPPs), industries, and transmission service operators.

How Siemens’ current gas and power business compares with other companies along the energy value chain. Courtesy: Siemens.

On April 1, Davis noted, Gas and Power had orders of €18.5 billion, revenues of €18.1 billion, and 65,000 employees. Factoring in SGRE’s shareholding, the company now has estimated orders of about €30 billion and revenue of €27 billion, and it has swollen to 88,000 employees. One benefit of grouping these businesses is that “we collectively are focused on the same customer groups, oil and gas, utilities, IPPs, and industry, and also have a lot of commonality across the different businesses where we can hopefully create even more strength as we go forward,” she said.

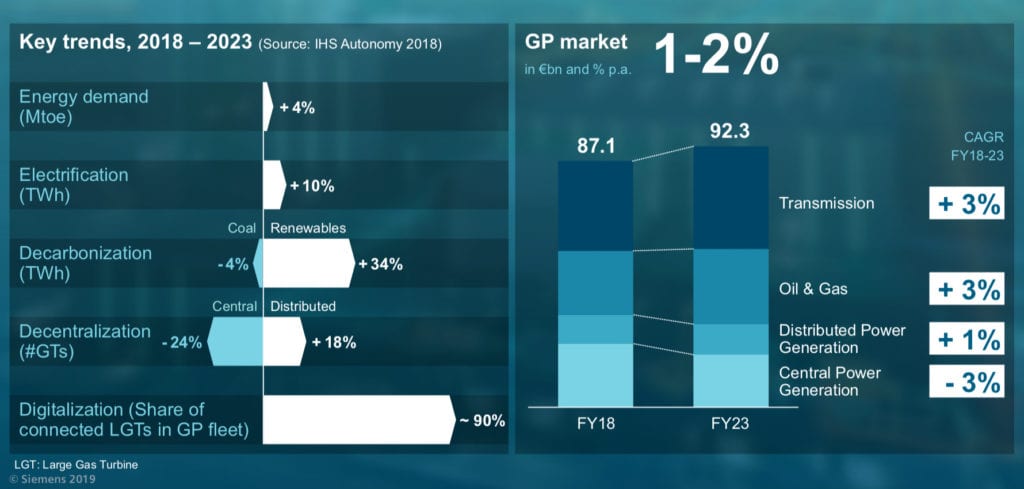

Going forward, the continued growth in energy demand and electrification will be “very core” to the new company, Davis said. “Having SGRE, having transmission in this business both allows us to participate with the renewables energy business in a bigger way,” she said. The current gas turbine portfolio will also allow the new company to participate in the drive for decarbonization in “all ranges of power plants, from the very small to the very large.”

The new company will bank on decarbonization, decentralization, and digitalization, as well as electrification, which it projects will be “key trends” through 2023. Courtesy: Siemens, May 2019

The addition of SGRE, specifically, would fuel growth in the business. “If you just look at gas and power to begin with, it’s about 1% to 2% growth. Adding the renewables business allows the new company to grow between 2% and 3%, just from a market perspective, and obviously aspirations to grow beyond market,” Davis said. “Also, what’s interesting with this new company … is an overall addressable market for gas and power alone of €92 billion. If you add to that the wind market as well, which obviously is the focus of Siemens Gamesa, that market more than doubles. So, this market and the capability that we have in this company is unprecedented.”

But growth won’t be easy, Davis said. It will require a continued “very strong ownership culture,” clear priorities and targets, and “a huge commitment to delivering, a huge commitment to our customers, to our future shareholders as we become an independent company, and obviously to the strength of the employee base that makes this all happen.”

Speculation Mounts

Ralf Thomas, Siemens chief financial officer, on May 7 noted that customers have been “encouraging” about the spinoff, though he declined to speak for investors. When asked how the measure would affect long-term shareholding decisions—in a business environment where investors want more clarity about the risks and opportunities associated with climate change—Thomas said investors of SGRE who will now find themselves part of a larger business with large stakes in conventional energy will still be part of a “pure renewable business, because Siemens Gamesa will still be listed on the stock exchange, running as it does today.”

However, Siemens’ business shuffle, along with a similar reorganization announced by GE in November to carve out its Power business, indicate the “continuing nature of trouble for companies with significant exposure to the conventional power business,” as Harminder Singh, director of Power at data and analytics firm GlobalData, told POWER in a statement on May 10. Total investment in the thermal business is set to decline 22%, from $122.9 billion in 2018 to $95.6 billion in 2025, he warned. “This declining trend, which has been continuing for the past five years, will significantly dent the revenues of players across the value chain, specifically those with low diversification.”

Singh also noted the renewable energy equipment market is “already very competitive and will pose high entry barriers to players that traditionally focused on conventional power.” Singh and other analysts project that market is ripe for more consolidation as key players form new alliances to gain a foothold in the renewables business. “Similar deals are also being witnessed in the utility space, a key example being the asset swap deal between E.ON and RWE last year,” he noted. As part of that March 2018–announced measure, E.ON sold its renewable business to RWE in exchange for RWE’s network and retail business. The German giants said the rejiggering of their separate focuses was a direct effort to tackle renewed disruptions heralded by decentralization and increasing competition.

The changing energy landscape will force players to look for new business models to serve new and emerging segments such as distributed generation, energy storage, electric vehicles, digitalization, etc,” Singh projected. “Players outside the power sector are eyeing these opportunities and challenging the traditional firms with disruptive innovations. Oil and gas majors such as Shell and Total are making their presence felt in some of these segments through acquisitions as part of their long-term strategy.”

For now, Siemens future as a key competitor in the gas turbine market now also appears unclear. Top global suppliers—Mitsubishi Hitachi Power Systems (MHPS), GE Power, Siemens, and Ansaldo Energia—are jostling for a secure future footing in the searing market, which Market Study Report LLC on May 10 projected would grow 11% in terms of revenue over the next five years. The research firm said the U.S. currently holds the largest share in the global market, generating 59% of total global revenue from gas turbine sales in 2018, but Asia-Pacific was the largest consumer of gas turbines, exceeding 42% of that market in 2018. The global gas turbine market size could nearly double, reaching $24.1 billion by 2024, from $14.3 billion in 2019, the firm said.

Speculation mounted in March that MHPS—which on May 9 reported “record financial results” in the 2018 fiscal year owing to notable orders of its J-series turbines in the Americas—could form a joint venture with Siemens’ gas and power business. Mitsubishi Heavy Industries (MHI) and Hitachi, MHPS’s parent companies, have both rolled out rejiggered power strategies amid disruptions that they say are shaking up prospects for traditional market growth. Hitachi has snapped up ABB’s lucrative power grids division in a bid to enlarge its access to the digitalization and grid modernization market, and MHI is aggressively pushing decarbonization solutions, including offshore wind, carbon capture technology, and development of hydrogen-fired gas turbines. But MHI declined to comment on a possible acquisition of Siemens’ gas and power business, telling POWER, “We are unable to comment on industry speculation.”

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine).

The post Insights Into Siemens’ Stunning Gas and Power, Renewables Shakeup appeared first on POWER Magazine.